Questor: this medical stock is expensive – but worth paying for

It’s a stock market rule of thumb that big acquisitions tend to destroy shareholder value. Spin-offs, on the other hand, have the reassuring habit of being more likely to create it.

A case in point is Alcon, the world’s biggest maker of both disposable and reusable contact lenses and equipment such as lasers and microscopes used in eye operations.

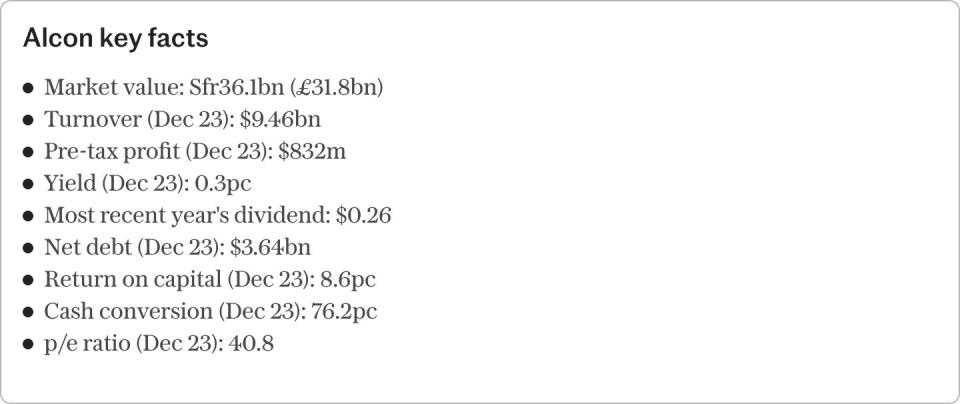

Since the Geneva-based group was spun out of Swiss pharmaceuticals giant Novartis five years ago, what were previously lacklustre sales have grown by nearly 30pc while underlying earnings before interest and tax (Ebit) is up more than 50pc.

The value of the listed business has grown by just over a quarter in the time while a steady improvement in its cash flows has enabled Alcon to start paying a modest dividend.

Analysts predict more of the same, or better, for the business in terms of sales, profits, margins, earnings per share and the dividend over coming years.

It’s an impressive performance, particularly given two of its five years of independence were blighted by Covid, which brought eye operations to a near standstill. And it has garnered the attention of some of the world’s best-performing fund managers, eight of whom have become owners of the stock.

These investors are among the top 3pc of the 10,000 equity fund managers tracked by financial publisher Citywire. Their conviction has led Alcon to gain an AA rating from Citywire Elite Companies, which rates companies on their backing by the world’s best investors.

Top-performing manager Alistair Wittet, who holds Alcon shares in a handful of funds including the Comgest Growth Europe fund, first bought a stake on the basis that the business was neglected under Novartis’s ownership and now had the freedom to pursue growth opportunities while improving efficiency.

“The evidence suggested that Novartis was essentially starving Alcon of the capital that it needed and at the same time putting huge costs and processes in place,” he said. “Alcon was in an ideal position to improve its innovation, and therefore its growth, which it has achieved since becoming independent. It’s been a big success story and has flourished on its own. That’s why we still really like it.”

Standing on its own has meant that Alcon’s management could tighten up processes and cut costs, pushing margins much higher and lifting profits. It has also been able to channel more money into research and development (R&D), which in turn boosts its launch of new products.

As an illustration, Alcon’s underlying operating margin has risen from 16.9pc to 19.7pc since the spin out and is forecast to hit 23.0pc by 2026. Meanwhile, R&D is up by over two fifths from $587m to $828m and now accounts for 9pc of sales compared with 8pc when owned by Novartis.

There are several trends that help underpin Alcon’s momentum.

First, the markets for eye care and ophthalmic surgery are sizeable and growing: Alcon estimates the two are worth $34bn (£27bn) in annual sales and projects them to grow by mid-single-digit percentages each year from now until 2028.

That growth should be reinforced as populations both grow and age, with a larger proportion of older people being more susceptible to ailments such as cataracts and glaucoma.

Then, there is the massive unmet need for treatment among sufferers of conditions such as dry eye, for example, which affects an estimated 1.4 billion globally. As technological advancements make treatments more affordable and accessible, Alcon’s addressable markets will grow further still.

And lastly, Alcon’s customers among prescribing doctors as well as consumers, tend to be very loyal. As Wittet put it: “It’s true of medicine generally that doctors tend to be pretty risk averse, and for good reason. If they know something works, they’ll stick with it.”

These dynamics have not gone unnoticed by the wider market, and Alcon shares are not cheap. They trade at 25 times forecast earnings for the next 12 months. But the real attractions of this company for several of the world’s best-performing professional investors lies in its potential for highly profitable growth over many years to come. That’s a prospect worth paying up for.

Questor says: buy

Ticker: SWX:ALC

Share price at close: Sfr72.16

Read the latest Questor column on telegraph.co.uk every Sunday, Tuesday, Wednesday, Thursday and Friday from 5am.

Read Questor’s rules of investment before you follow our tips.

Yahoo Finance

Yahoo Finance