Motorola (MSI) Q1 Earnings Beat Estimates on Record Revenues

Motorola Solutions, Inc. MSI reported strong first-quarter results with record revenues and cash flow, driven by the diligent execution of operational plans and healthy growth dynamics backed by solid order trends.

Both adjusted earnings and revenues surpassed the respective Zacks Consensus Estimate. In addition, Motorola ended the quarter with a record backlog, which further exemplified the strength of its portfolio. The company expects this growth momentum to continue in the near term on robust demand patterns and raised its earlier guidance for 2024.

Net Earnings

On a GAAP basis, Motorola reported a GAAP loss of $39 million or a loss of 23 cents per share against a net income of $278 million or $1.61 per share in the year-earlier quarter. The sharp year-over-year decline was primarily attributable to a $585 million non-operating loss due to the accounting treatment for the settlement of the Silver Lake convertible debt.

Excluding non-recurring items, non-GAAP earnings in the quarter were $482 million or $2.81 per share compared with $384 million or $2.22 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 29 cents.

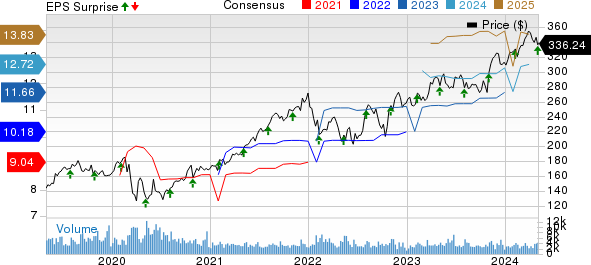

Motorola Solutions, Inc. Price, Consensus and EPS Surprise

Motorola Solutions, Inc. price-consensus-eps-surprise-chart | Motorola Solutions, Inc. Quote

Revenues

Quarterly net sales were record high at $2.39 billion, up 10% year over year, with solid sales in both segments across all regions driven by the strength of its business model and the value of its mission-critical integrated ecosystem. The company witnessed strong demand for video security, command center software and LMR (land mobile radio) services. The top line beat the consensus estimate of $2.34 billion.

Region-wise, quarterly revenues were up 13% in North America to $1.69 billion due to growth in LMR, command center software and video security products. International revenues were up 3% to $696 million, with growth in video security products, LMR and command center software. Acquisitions contributed $10 million to revenues, while foreign exchange tailwinds were $1 million.

Segmental Performance

Net sales from Products and Systems Integration increased to $1.49 billion from $1.3 billion in the year-ago quarter, driven by higher demand for LMR and video security solutions. It also exceeded our estimates of $1.42 billion. The segment’s backlog was down $74 million to $4.6 billion, primarily due to unfavorable currency translation.

Net sales from Software and Services were up 3.6% to $899 million, with solid performance across command center software, LMR and video security services. However, the segment’s revenues missed our estimates of $926 million. The segment’s backlog increased $404 million to $9.8 billion, owing to strong demand for multi-year services and contracts in both regions.

Other Quarterly Details

GAAP operating earnings increased to $519 million from $399 million in the prior-year quarter, while non-GAAP operating earnings were up to $638 million from $532 million. The company ended the quarter with a record backlog of $14.4 billion, up $331 million year over year.

Overall GAAP operating margin was 21.7%, up from 18.4%, while non-GAAP operating margin was 26.7% compared with 24.5% in the year-ago quarter. Non-GAAP operating earnings for Products and Systems Integration were up 50.4% to $370 million for a margin of 24.8%, driven by higher sales, a favorable mix and improved operating leverage. Non-GAAP operating earnings for Software and Services were $268 million, down 6.3% year over year, for a non-GAAP operating margin of 29.8% due to the impact of the Airwave charge control.

Cash Flow and Liquidity

Motorola generated $382 million in cash from operating activities in the reported quarter against a cash utilization of $8 million a year ago. Free cash flow in the first quarter was $336 million. The company repurchased $39 million worth of stock during the quarter. As of Mar 31, 2024, MSI had $1.51 billion of cash and cash equivalents with $6 billion of long-term debt.

Guidance

With solid quarterly results and robust demand patterns, the company raised its guidance for 2024. Non-GAAP earnings for 2024 are currently expected in the $12.98-$13.08 per share range, up from $12.62-$12.72 on revenue growth of 7% (up from 6% expected earlier), with a rise in both segments on higher demand.

For second-quarter 2024, non-GAAP earnings are expected in the $2.97-$3.02 per share range on year-over-year revenue improvement of 7-8% due to healthy demand trends.

Moving Forward

Motorola is poised to gain from disciplined capital deployment and a strong balance sheet position. The company expects strong demand across LMR products, the video security portfolio, services and software while benefiting from a solid foundation.

Motorola currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Cogent Communications Holdings, Inc. CCOI is scheduled to release first-quarter 2024 earnings on May 9. The Zacks Consensus Estimate for earnings is pegged at a loss of 80 cents per share, suggesting a decline of 715.4% from the year-ago reported figure.

Akamai Technologies, Inc. AKAM is slated to release first-quarter 2024 earnings on May 9. The Zacks Consensus Estimate for earnings is pegged at $1.61 per share, indicating growth of 15% from the year-ago reported figure.

Akamai has a long-term earnings growth expectation of 7.3%. AKAM delivered an average earnings surprise of 6.5% in the last four reported quarters.

Keysight Technologies, Inc. KEYS is set to release second-quarter fiscal 2024 earnings on May 20. The Zacks Consensus Estimate for earnings is pegged at $1.38 per share, implying a decline of 34.9% from the year-ago reported figure.

Keysight has a long-term earnings growth expectation of 4.1%. KEYS delivered an average earnings surprise of 6.4% in the last four reported quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance