Is Kohl's a Value Play or Value Trap?

Retailer Kohl's Corp. (NYSE:KSS) has proven to be a disappointing investment. Over the past three years, its shares have delivered a total return of roughly -56%. Comparably, the S&P 500 has delivered a total return of around 25% over the same period.

The company has experienced significant multiple contraction over the past few years and now trades at just 9.80 times consensus 2024 earnings per share and at a forward enterprise value-to-Ebitda ratio of just 2.90.

The stock is cheap for a reason as the company has a highly levered balance sheet and operates in a very challenging cyclical industry, which is highly competitive.

Company overview

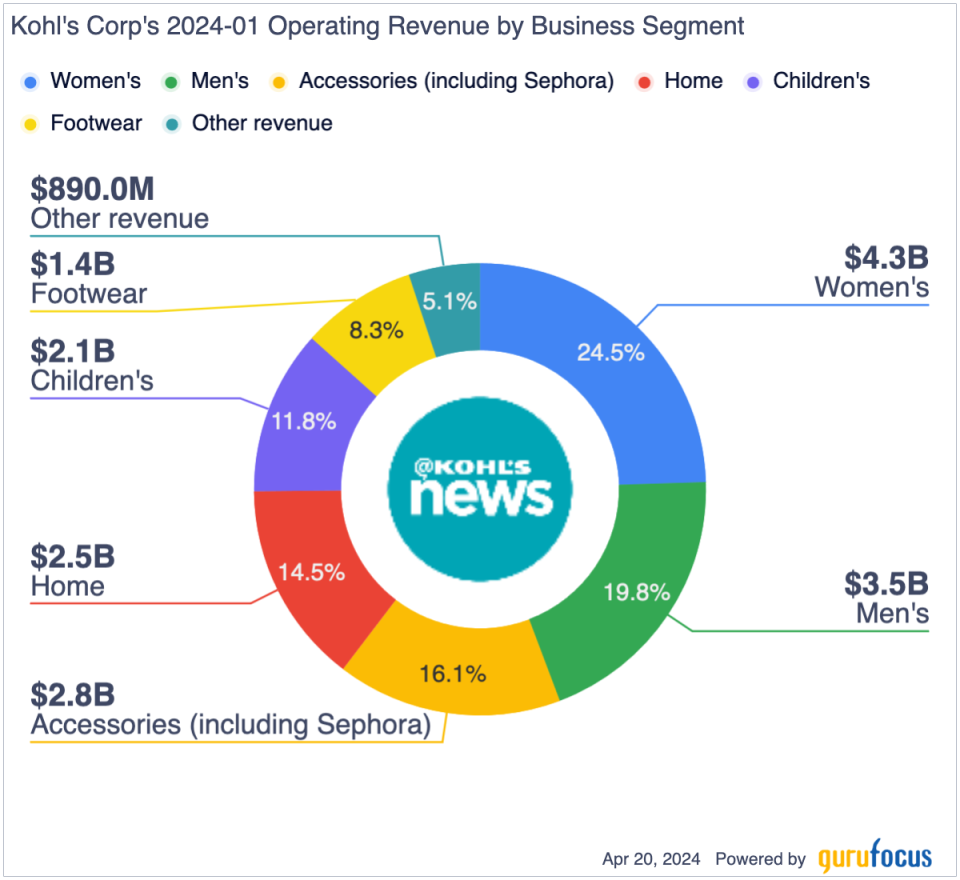

Kohl's is a leading U.S. retailer with in-store and online operations. The company operates roughly 1,174 stores across the United States and serves over 60 million customers. The company has an important partnership with Sephora, which operates over 900 stores within Kohl's locations.

While Kohl's generates the bulk of its revenue from sales in its physical retail locations, it has a significant online business that accounts for roughly 29% of total net sales.

The company focused on the value part of the retail segment, but also offers key brands such as Sephora, Nike, Levi's and others.

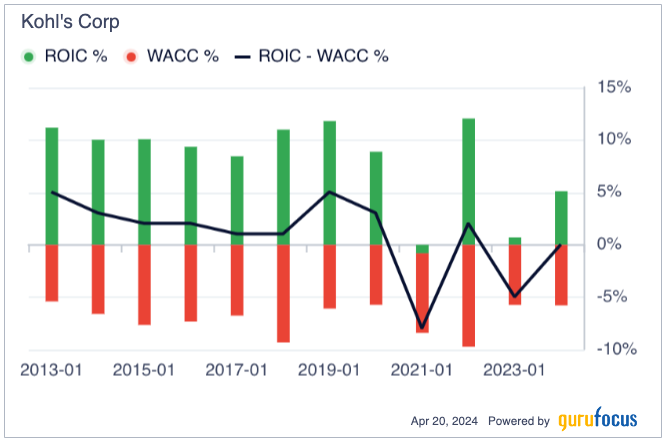

Highly competitive industry, resulting in low returns on invested capital

The retail industry is highly competitive and has low barriers to entry. Kohl's competes with a wide variety of retailers, including Macy's (NYSE:M), Target (NYSE:TGT), Walmart (NYSE:WMT), TJ Maxx (NYSE:TJX), JC Penney, Dillard's (NYSE:DDS), Amazon (NASDAQ:AMZN), Ross Stores (NASDAQ:ROST) and many others. The intense competition has resulted in low profit margins for Kohl's and other retailers.

In addition to being highly competitive, the retail industry is highly capital intensive as retailers are forced to hold significant amounts of inventory in order to operate.

As a result of these factors, as shown by the chart below, Kohl's has historically generated fairly low returns on invested capital relative to its weighted average cost of capital.

Growth outlook

Kohl's expects full-year 2024 sales growth to be in a range of -1% to 1% compared to 2023 levels, while comparable store sales growth is expected to be in a range of 0% to 2%. The company expects operating margins to come in at 3.60% to 4.10%. Comparably, the company reported a roughly 4.10% operating margin for 2023. Over a longer-term horizon, Kohl's believes it can achieve an operating margin of 7% to 8%.

The company projects full-year 2024 diluted earnings per share of $2.10 to $2.70 compared $2.85 reported for 2023. Currently, consensus estimates call for it to report 2024 earnings of $2.37 per share. Thus, consensus estimates are roughly in line with the midpoint of the company's provided guidance.

The drop in 2024 earnings versus 2023 levels is due in part to the negative impact of a recent CFPB rule which will limit the amount that credit card issuers can charge for late fees. Additionally, the company benefited from a 53rd week as part of its fiscal 2023 year.

Historically, over the past five- and 10-year periods, Kohl's has struggled to generate revenue and profit growth. I do not expect that to change going forward given the challenging nature of the company's business and increasing threat from online retailers such as Amazon, Temu and Shein.

Highly levered balance sheet

Currently, Kohl's has a trailing leverage ratio of 3.60 based on adjusted debt-to-Ebitda. While the company is focused on improving its balance sheet and had reduced its long-term debt by more than $1 billion since 2017, it remains highly levered.

In early April 2024, Fitch downgraded Kohl's credit rating to BB+ from BBB-. S&P and Moody's had already downgraded the company's credit rating to junk status. Fitch noted it believes that Kohl's business will remain challenging and the company can only generate roughly flat revenue and Ebitda growth in a best-case scenario over the medium term.

Kohl's high level of leverage is a key headwind as is operates in a highly cyclical business with significant earnings and free cash flow volatility. I believe the company can manage through near-term maturities, but longer-term maturities, including $500 million of notes coming due in 2031, may prove more problematic if interest rates remain elevated. Currently, the $500 million of notes due in 2031 carry a coupon rate of just 4.63%, which is significantly below the level at which Kohl's would be able to refinance this debt in the current interest rate environment.

Valuation not compelling versus peers

Kohl's currently trades at roughly 9.80 times 2024 consensus earnings per share. Comparably, the S&P 500 trades at roughly a multiple of 21 times. While the retailer is cheaper than the broader market, it is cheap because the business is highly cyclical with very low growth prospects. Given these factors, I view a peer valuation comparison as more reasonable.

The retailer's closest peers are Macy's and Nordstrom (NYSE:JWN) as these companies face similar headwinds. Currently, both of these companies are subject to takeover speculation as Macy's has received a bid from two investment firms while the Nordstrom family is said to be considering a take private transaction of the namesake retailer.

Macy's currently trades at 7 times 2024 consensus earnings per share, while Nordstrom trades at a multiple of 10.50. Thus, on a relative basis, Kohl's valuation of 9.80 is not highly compelling. This is especially true given the fact that Macy's and Nordstrom's current valuations are supported by takeover speculation.

Potential upside catalysts

One potential upside catalyst is Kohl's is able to successfully execute on its transformation strategy. Perhaps the most ambitious target the company has is to achieve an operating margin of 7% to 8%, up from current levels of 4.10%. The company believes margin expansion can be driven by increased sales growth leverage, better inventory management, improved marketing efficiency and more automation. I am somewhat skeptical it will be able to deliver on this target as an operating margin of 7% to 8% is well above the company's historical average. However, if the retialer is able to deliver on this objective, I would expect material earnings per share growth from current levels.

Another potential upside catalyst is the emergence of a possible take private bid. Kohl's has previously been the target on take private transactions and could be a compelling candidate for private equity companies with experience in the retail space. In 2022, it was the target of competing bids from Starboard Value, Sycamore Partners and Franchise Group, which valued the company as high as $65 per share. Hudson's Bay was also said to be a potential bidder for the company in 2022. Ultimately, Kohl's rejected all of these takeover bids. However, it is possible that takeover bids re-emerge given the recent drop in its share price.

Conclusion

Kohl's is a cheap stock for good reasons. The company operates in a highly competitive, capital intensive, cyclical industry, which has made it challenging for it to deliver strong returns on invested capital historically. The near-term growth outlook for Kohl's is challenging and any material earnings growth is reliant on margin expansion from current levels. The company has a highly levered balance sheet, which leaves limited room for operational errors and exposes it to any further increases in interest rates.

Currently, Kohl's is trading at a valuation that is roughly in line with key peers. However, Macy's and Nordstrom have benefited from recent takeover speculation. Thus, on a relative basis I do not find the stock's valuation compelling.

Rather, I view Kohl's as a value trap at current levels.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance