Here's Why Morgan Stanley (MS) Stock is a Must Buy Right Now

Morgan Stanley MS is well-positioned for growth on the back of strategic expansion efforts and a solid balance sheet. A favorable macroeconomic backdrop is expected to revive its investment banking (IB) business, thereby further strengthening the company’s financials.

Analysts are also optimistic about the stock’s earnings growth potential. Over the past seven days, the Zacks Consensus Estimate for earnings for both 2024 and 2025 has moved 1% and 1.2% north, respectively. MS currently sports a Zacks Rank #1 (Strong Buy).

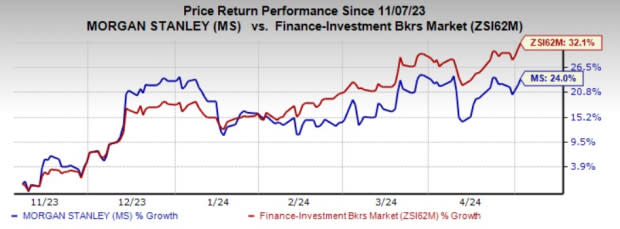

Over the past three months, shares of Morgan Stanley have rallied 24%, underperforming the industry’s growth of 32.1%.

Image Source: Zacks Investment Research

Let’s dive deeper into the reasons that make MS stock a lucrative bet now.

Earnings Growth: Morgan Stanley witnessed earnings growth of 4.7% over the past three to five years, driven by decent top-line growth and strategic buyouts.

With the operating backdrop turning favorable for the investment banking segment, growth in wealth management and investment management segments and strategic expansion, the company’s earnings are expected to continue the upward momentum. Hence, we expect earnings to grow at the rate of 23.6%, 11.2% and 4.1% in 2024, 2025 and 2026, respectively.

Revenue Strength: Morgan Stanley remains focused on its revenue growth. The company’s net revenues witnessed a CAGR of 6.2% in the last five years (2018-2023), primarily attributable to growth in investment management and wealth management segments as the company lowers its reliance on capital markets-driven revenues. This also helped it mitigate volatility in the top line.

Additionally, the recent rebound in the IB business after two years of subdued performance is expected to support Morgan Stanley’s revenues going forward. The demand for both advisory and underwriting businesses will likely tick up as corporates realize that higher interest rates are here to stay for a longer period.

Our estimate for total net revenues implies 6.3%, 4.2% and 2% growth in 2024, 2025 and 2026 revenues, respectively.

Strategic Expansion Efforts: MS has undertaken strategic expansion initiatives over the past few years, driven by its strong liquidity and balance sheet position. This has also helped the company expand internationally, mainly in Europe and Canada.

In July 2023, Morgan Stanley announced plans to merge its certain operations with Mitsubishi UFJ Financial Group, Inc. (MUFG) to further expand its presence in Japan. This MUFG deal aims to combine Japanese equity research, sales and execution services for institutional clients with underwriting business to be rearranged between two brokerage units. Besides that, the opportunistic buyouts of Eaton Vance, E*Trade Financial and Shareworks poise Morgan Stanley well for future growth.

Strong Balance Sheet: As of Mar 31, 2024, Morgan Stanley had a long-term debt of $266.2 billion, with roughly $19.7 billion set to mature over the upcoming 12 months. Further, the company’s cash and cash equivalents were $102.3 billion. Given the investment-grade ratings and stable outlook from rating agencies, along with solid earnings strength, the company will be able to meet its debt obligations even if the economic situation worsens.

Steady Capital Distributions: Morgan Stanley’s capital distribution activities remain encouraging. Following the 2023 stress test results, the company hiked its dividend by 10% to 85 cents per share in July. Concurrently, the company re-authorized the repurchase of shares worth up to $20 billion, effective in third-quarter 2023. As of Mar 31, 2024, $16.2 billion remained under the buyback authorization.

Given a robust capital and liquidity position and earnings strength, the company is expected to continue efficient capital distributions, thus enhancing shareholder value.

Stock Seems Undervalued: Morgan Stanley’s stock seems undervalued as its price-to-earnings (F1) and price-to-book ratios of 13.69 and 1.68, respectively, are well below industry averages of 17.28 and 2.39.

Other Stocks to Consider

A couple of other stocks from the financial services space worth a look are Interactive Brokers IBKR and Stifel Financial SF.

The Zacks Consensus Estimate for Interactive Brokers’ current-year earnings has been revised 4.9% north over the past 30 days. Shares of this Zacks Rank #1 company have risen 27.2% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Stifel Financial’s 2024 earnings have been revised 1.4% north over the past 60 days. Over the past three months, shares of this Zacks Rank #2 (Buy) company have gained 9.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Stifel Financial Corporation (SF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance