Fintech Stock Could Bounce Says Bull Signal

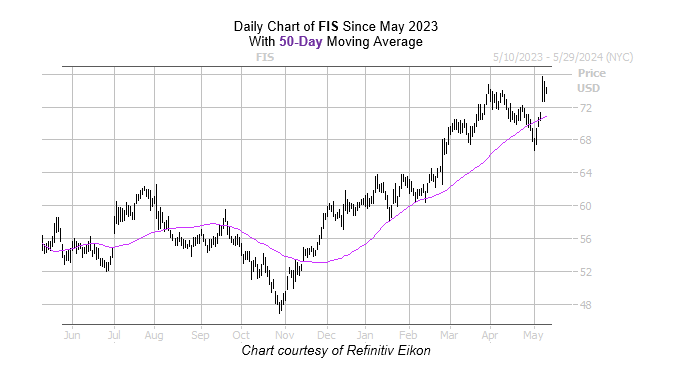

Shares of fintech firm Fidelity National Information Services Inc (NYSE:FIS) are trading at their highest level since February 2023 following a post-earnings gap higher on the charts. The equity also reclaimed support from its 50-day moving average after earnings, though the $76 level kept a lid on further gains. However, a "buy" signal is flashing that could keep the wind at the stock's back.

Specifically, FIS' Schaeffer's Volatility Index (SVI) of 22% is higher than just 4% of the other readings from the past year, pointing to relatively attractive short-term premiums amid muted volatility expectations.

The other four times over the past five years the stock traded near new highs while its SVI ranked in the bottom 20th percentile of its annual range, the shares were higher 75% of the time, and averaged a one-month gain of 3.95%, per data from Schaeffer's Senior Quantitative Analyst Rocky White. A move of similar magnitude from the security's current perch of $73.50 would put it at roughly $76.40.

Puts are popular amongst short-term traders, and a shift in sentiment could help FIS move even higher. This is according to its Schaeffer's put/call open interest ratio (SOIR) ranks higher than all other readings from the past 12 months.

Yahoo Finance

Yahoo Finance