Exploring Top TSX Dividend Stocks In May 2024

As the Canadian market continues to benefit from moderating inflation trends and a robust economic backdrop, investors are increasingly looking towards stable income-generating options. In this context, dividend stocks emerge as particularly appealing investments, offering potential for steady returns amid fluctuating market conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.43% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.96% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.72% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.59% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.49% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.00% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.80% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.43% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

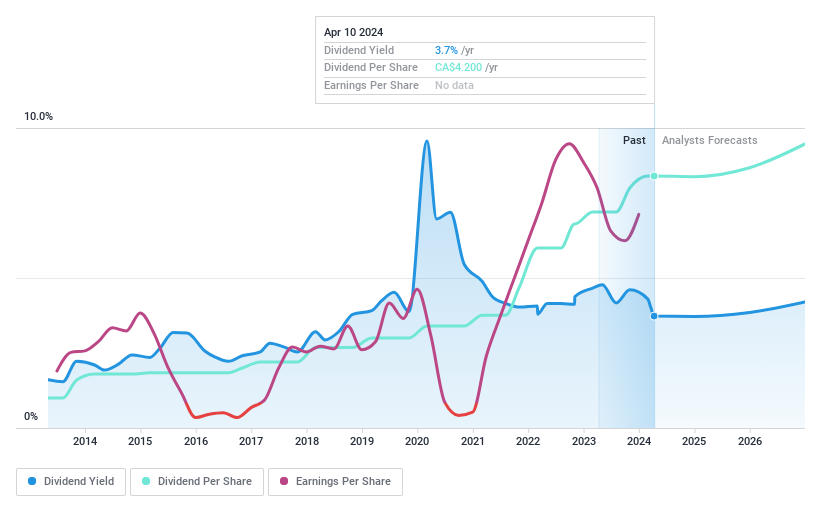

Canadian Natural Resources

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited, a company operating in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and NGLs, has a market capitalization of approximately CA$112.04 billion.

Operations: Canadian Natural Resources Limited generates revenue primarily through three segments: Oil Sands Mining and Upgrading at CA$15.80 billion, Exploration and Production in North America at CA$17.43 billion, and smaller contributions from Midstream and Refining at CA$0.97 billion, as well as international operations in the North Sea and Offshore Africa totaling CA$1.16 billion.

Dividend Yield: 4%

Canadian Natural Resources (CNQ) offers a steady dividend yield of 4%, with a history of reliable payouts over the past decade, supported by a payout ratio of 56.2% and cash flows covering 49%. Despite the lower yield compared to top Canadian dividend payers, CNQ has demonstrated commitment to shareholder returns through consistent dividend growth and recent approval for a stock split, enhancing share liquidity. However, recent financial results show reduced net income and earnings per share compared to previous periods.

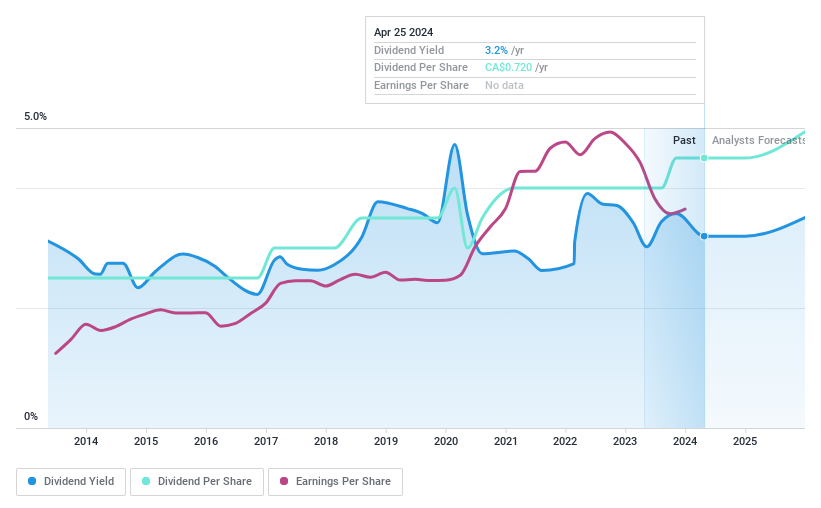

Leon's Furniture

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited operates in Canada as a retailer of home furnishings, mattresses, appliances, and electronics, with a market capitalization of approximately CA$1.53 billion.

Operations: Leon's Furniture Limited generates CA$2.50 billion in revenue primarily from the sales of home furnishings, mattresses, appliances, and electronics.

Dividend Yield: 3.2%

Leon's Furniture trades significantly below estimated fair value, providing a potential opportunity despite its low dividend yield of 3.21% relative to Canada's top dividend stocks. The dividends are well-supported by both earnings and cash flow, with payout ratios at 31.9% and 25.1%, respectively. However, the company has experienced volatility in dividend payments over the past decade and significant insider selling recently, raising concerns about long-term sustainability and confidence among insiders.

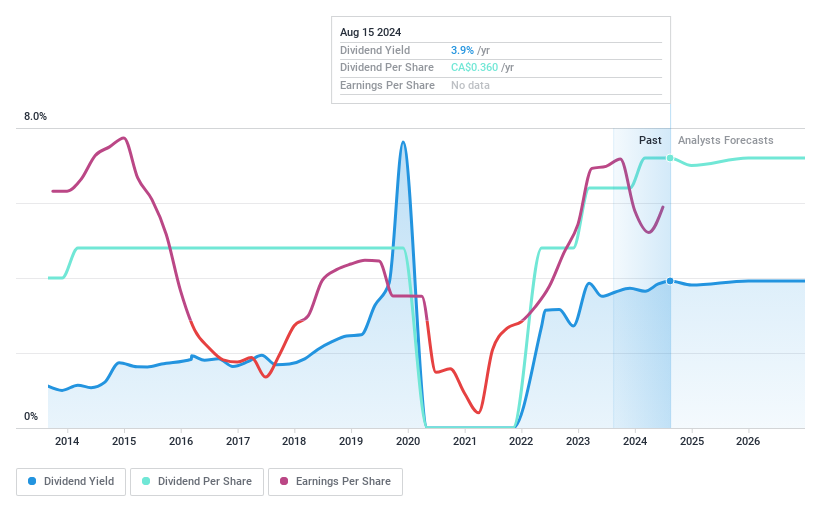

Total Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company with operations mainly in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$371.36 million.

Operations: Total Energy Services Inc. generates its revenue primarily through energy services in Canada, the United States, and Australia.

Dividend Yield: 3.9%

Total Energy Services reported a decrease in Q1 2024 sales and net income compared to the previous year, with sales dropping to CAD 204.69 million and net income to CAD 15.48 million. Despite this downturn, the company increased its quarterly dividend by 13% to $0.09 per share, signaling confidence in its financial health. The dividend is well-covered by earnings, with a payout ratio of 38.7%, and cash flows, with a cash payout ratio of 18.1%. However, Total Energy's dividends have been inconsistent over the past decade, reflecting some instability in its dividend policy.

Seize The Opportunity

Explore the 32 names from our Top TSX Dividend Stocks screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CNQ TSX:LNF and TSX:TOT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance