Decoding Host Hotels & Resorts Inc (HST): A Strategic SWOT Insight

Host Hotels & Resorts Inc showcases robust revenue growth and operating profit margin expansion.

Despite a slight dip in net income, the company maintains a strong balance sheet with increased EBITDAre.

Strategic divestitures and a focus on luxury and upper-upscale hotels position Host for competitive advantage.

Recent acquisitions signal a forward-looking growth strategy amidst a challenging economic landscape.

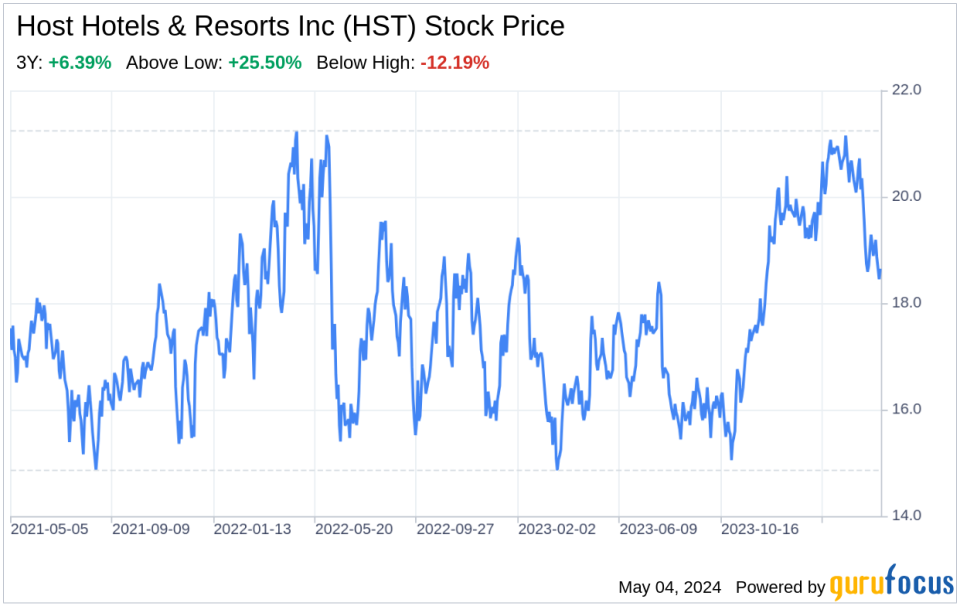

On May 3, 2024, Host Hotels & Resorts Inc (NASDAQ:HST), a premier owner of luxury and upper-upscale hotels, reported its first-quarter financial results through the 10-Q filing. The company's portfolio, predominantly located in the United States, consists of 77 properties, with a strong presence under the Marriott and Starwood brands. Despite a slight decrease in net income from $291 million in Q1 2023 to $272 million in Q1 2024, Host Hotels & Resorts Inc demonstrated a 6.5% increase in total revenues, reaching $1,471 million. Operating profit surged by 17.3%, and the operating profit margin under GAAP improved by 180 basis points to 19.8%. Adjusted EBITDAre also saw an 8.8% increase, indicating a solid operational performance. The company's strategic divestitures of its interests in European and Asian joint ventures, along with other U.S. properties, reflect a focused approach to optimizing its portfolio.

Strengths

Brand Power and Portfolio Quality: Host Hotels & Resorts Inc's strength lies in its high-quality portfolio of luxury and upper-upscale hotels, primarily operating under the prestigious Marriott and Starwood brands. This association with renowned brands enhances the company's market presence and customer loyalty. The strategic focus on urban and resort properties in key markets positions Host to capitalize on high-demand segments, driving revenue per available room (RevPAR) and maintaining a competitive edge.

Financial Robustness: The company's financial health is underscored by its strong balance sheet and revenue growth. The 6.5% increase in total revenues and the expansion of the operating profit margin reflect efficient cost management and an ability to drive top-line growth. The 13.5% increase in EBITDAre further demonstrates Host's operational efficiency and its capacity to generate cash flow, which is crucial for reinvestment and shareholder returns.

Strategic Asset Management: Host's recent divestitures and acquisitions indicate a proactive asset management strategy. By selling off non-core assets and investing in strategic properties, such as the 215-room 1 Hotel Nashville and 506-room Embassy Suites by Hilton Nashville Downtown, Host is refining its portfolio to focus on high-potential markets and properties that align with its growth objectives.

Weaknesses

Net Income Decline: Despite revenue growth, Host Hotels & Resorts Inc experienced a 6.5% decrease in net income in the first quarter of 2024 compared to the same period in 2023. This decline may raise concerns among investors regarding the company's ability to translate revenue increases into net profit consistently. It is essential for Host to analyze the underlying causes, such as potential increases in operating expenses or one-time charges, and address them to ensure sustained profitability.

Dependence on Brand Partners: The company's significant reliance on Marriott and Starwood brands, while a strength, also poses a risk. Changes in the relationship with these brand partners or shifts in their strategic direction could impact Host's operations and market positioning. Diversifying its brand portfolio could mitigate this dependence and spread operational risk.

Impact of Strategic Shifts: The recent sale of international joint venture interests and other U.S. properties may lead to short-term disruptions and a potential loss of revenue from those assets. Host must manage these transitions effectively to ensure that the long-term benefits of these strategic moves outweigh the immediate impacts.

Opportunities

Market Recovery and Demand Growth: As the economy recovers from the pandemic and travel demand rebounds, Host Hotels & Resorts Inc is well-positioned to benefit from increased occupancy and average daily rates. The company's focus on luxury and upper-upscale hotels, which are expected to see a faster recovery, presents an opportunity to capture a larger market share and drive revenue growth.

Strategic Acquisitions: Host's recent acquisitions demonstrate its ability to identify and capitalize on strategic growth opportunities. The company's strong balance sheet and access to capital allow it to pursue further acquisitions, enhancing its portfolio and geographic diversity, and positioning it for long-term growth.

Operational Excellence: Host's operational efficiency, as evidenced by its improved EBITDAre, provides an opportunity to further optimize costs and enhance profitability. Continued focus on operational excellence can lead to sustained improvements in margins and cash flow generation.

Threats

Economic Uncertainty: The potential for an economic recession, coupled with high inflation and rising interest rates, poses a threat to the hospitality industry. Host Hotels & Resorts Inc must navigate these macroeconomic challenges, which could impact travel demand and the company's financial performance.

Geopolitical Risks: Geopolitical tensions and international conflicts can affect global travel patterns and have a direct impact on Host's operations. The company must remain vigilant and adaptable to mitigate the effects of such external risks on its business.

Competition and Market Saturation: The luxury and upper-upscale hotel segments are highly competitive, with new entrants and existing players vying for market share. Host must continue to innovate and differentiate its offerings to maintain its competitive position in a potentially saturated market.

In conclusion, Host Hotels & Resorts Inc (NASDAQ:HST) presents a strong financial and strategic profile, with robust revenue growth, a high-quality portfolio, and a proactive approach to asset management. However, the company must address the decline in net income, manage its brand partner dependencies, and

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance