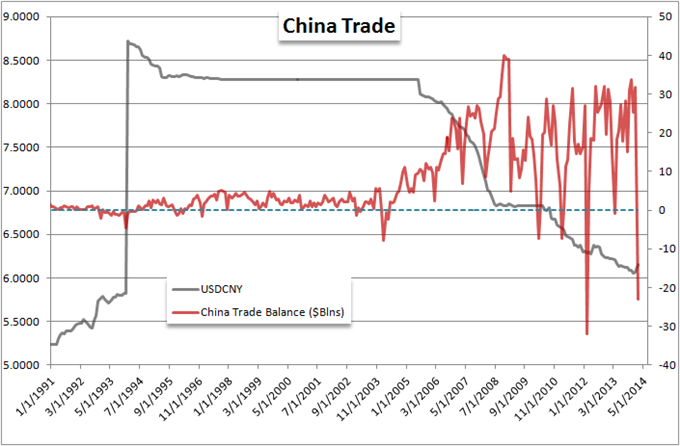

China Surprises with Second Largest Trade Deficit on Recent Record

Talking Points

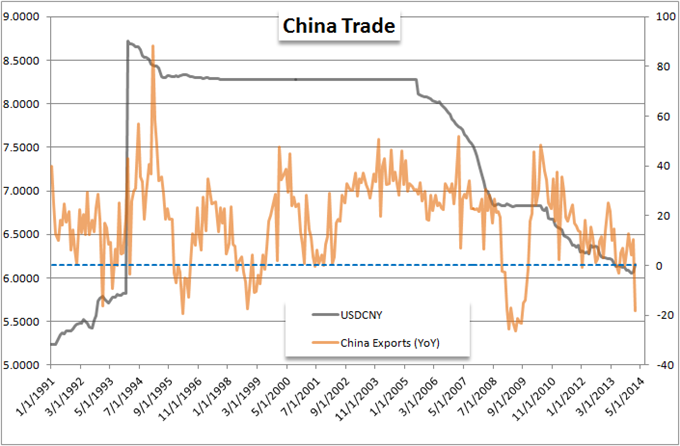

-China’s exports fell 18.1% year over year for the biggest drop since August 2009

-With the sharp decline in shipments, posted only its fifth deficit (-$22.98 billion)in a decade

- Part of this severe number is likely due to the Chinese New Year Holiday and corrections to data manipulation

In a Saturday release, China reported its exports unexpectedly fell 18.1 percent in February compared to last year, while imports climbed 10.1 percent. The result of the dramatic decline in shipments abroad resulted in a trade deficit of $22.98 billion. This was the largest trade short fall in two years and the second largest in decades.Economists were expecting exports to rise by 7.5% and a surplus of $14.5 billion.

According to the General Administration of Customs in China, this significant miss is in part due to a seasonality effect. Merchants followed their "business habit" of bringing forward exports ahead of the Chinese Lunar New Year holiday, with many plants and offices shut down for extended periods during the festival. "The Spring Festival factor caused sharp fluctuations in the monthly growth rate as well as the monthly deficit," Customs said in a statement accompanying the data.Chinese exports have historically experienced significant declines in the opening months of the year.

Expect breakouts? Use the DailyFX Breakout 2 strategy to signal or confirm setups!

China’s Yuan has rallied over the past week to close at 6.127 per dollar after a steep drop beginning mid-February. The tumble was engineered by China’s central bank as it prepares the currency, currently kept within a tight daily range, for wider trading as the PBOC pushes financial reform. Chinese Premier Li Keqiang said, at the annual legislative session on Wednesday, that the 1% daily band would be expanded.

Taking both January and February, exports still fell 1.6% from the same period last year. China’s exports and imports grew by 7.6% in 2013, barely missing the PBOC target of 8% growth.

Despite the seasonal factors to this figures, taken with the admission of data manipulation, the slowing of economic activity and the country’s first trust default; this may still have a significant effect on risk trends and the Australian dollar come Monday.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance