Charles Brandes' Top Year End Stocks

A disciple of value investing Guru Benjamin Graham, Charles Brandes founded Brandes Investment Partners in 1974. Brandes' funds continue to perform well, with both the Global Equity fund and the International Equity fund producing double digit returns over the past year.

Over the fourth quarter, Brandes bought 18 new stocks bringing his total number of stocks held to 169. The guru's portfolio is currently valued at over $8.1 billion.

America Movil S.A.B. de C.V. (AMX)

The guru's largest holding is in America Movil where he owns 16,491,148 shares. His position in the company makes up for 4.8% of his entire portfolio as well as 0.43% of the company's shares outstanding.

During the fourth quarter Brandes reduced his position -1.31%% by selling 218,566 shares of the company's stock. He sold these shares in the quarterly price range of $19.56 to $23.51, with an estimated average quarterly price of $21.80 per share. The price per share has dropped -4.1% since then.

Brandes' holding history:

America Movil, based in Mexico, is the largest provider of wireless communications services in Latin America based on subscribers. The company offers services in 18 countries, maintains more than 263 million mobile customers and holds the capability of coverage for a combined population of 847 million.

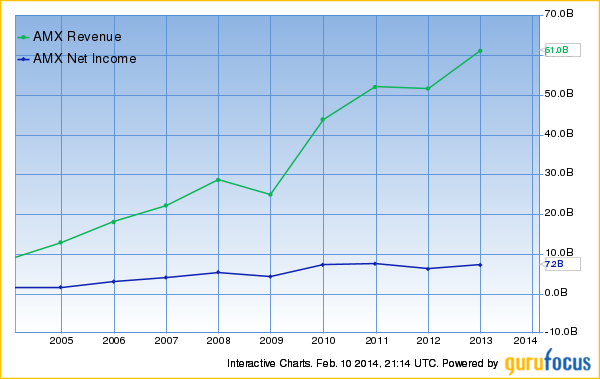

America Movil's historical revenue and net income:

The analysis on America Movil reports that its revenue has been in decline over the past year, it has issued MXN12.3 billion of debt over the past three years and its dividend yield is at a 10-year high.

The Peter Lynch chart shows that America Movil appears to be undervalued:

America Movil has a market cap of $75.57 billion. Its shares are currently trading at around $20.93 with a P/E ratio of 13.50, a P/S ratio of 1.30 and a P/B ratio of 4.50. The company had an annual average earnings growth of 21.90% over the past ten years.

GuruFocus rated America Movil the business predictability rank of 3-star.

Tim Participacoes SA (TSU)

The guru's second largest holding is in Tim Participacoes, formerly known as Tim Holding Company. The guru holds on to 13,565,183 shares of the company's stock, representing 4.4% of the company's shares outstanding.

Over the past quarter Brandes reduced his holdings -23.31% by selling a total of 4,122,481 shares of the company's stock. He sold these shares near the estimated average quarterly price of $25.26 per share. And since this sell the shares are trading up about 5.2%.

Brandes' historical holding history:

Tim Participacoes is the largest company in Brazil that offers mobile cellular service throughout the Brazilian territory, by means of its subsidiaries TIM Celular S.A. and TIM Nordeste S.A. The company is the largest GSM (Global System for Mobile communications) operator of the country, in terms of clients and revenues.

The analysis on Tim Participacoes SA reports that the company's revenue has slowed over the past year, its dividend yield is close to a 5-year low and that its operating margin is expanding.

Charles Brandes, Jim Simons and Steven Cohen are the only gurus that currently hold a position in Tim Holding.

Tim Participacoes has a market cap of $12.93 billion. Its shares are currently trading at around $26.74 per share with a dividend yield of 1.40%.

Petroleo Brasileiro SA Petrobras (PBR.A)

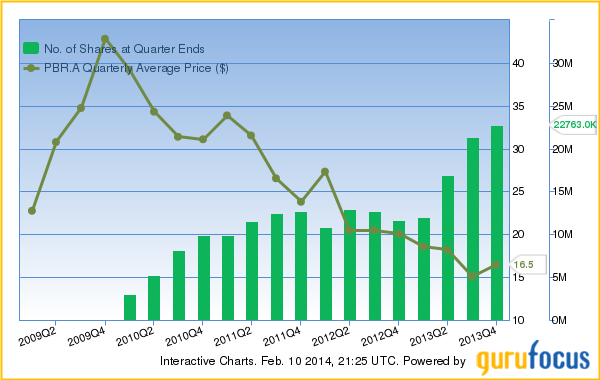

Brandes' third largest holding goes to Petrobras where the guru maintains 21,332,286 shares of the company's stock. Brandes' position makes up for 4.9% of his entire portfolio as well as 0.33% of the company's shares outstanding.

During the fourth quarter Brandes increased his position 26.19% by purchasing 4,426,832 shares. The guru purchased these shares in the fourth quarter price range of $14.33 to $18.79, with an estimated average quarterly price of $16.47. Since then the price per share has dropped -26.8%.

Brandes' holding history as of the fourth quarter:

It is an integrated oil and gas company in Brazil and in Latin America who is the supplier of crude oil and oil products. Its activities comprise five business segments: Exploration and Production, Supply, Distribution, Gas and Energy and International.

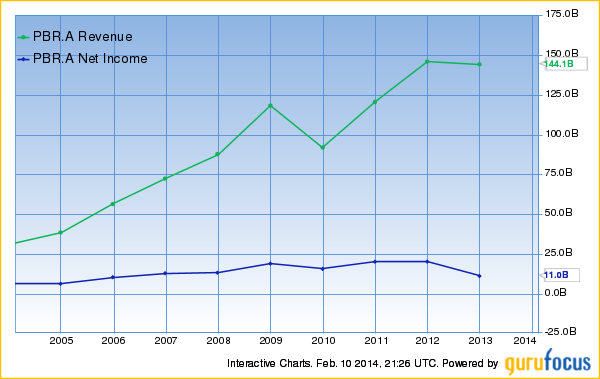

Petrobras' historical revenue and net income:

The analysis on Petrobras reports that the company's revenue has been in decline over the past five years. It also notes that the company has issued $48.2 billion of debt over the past three years but that its debt level is acceptable.

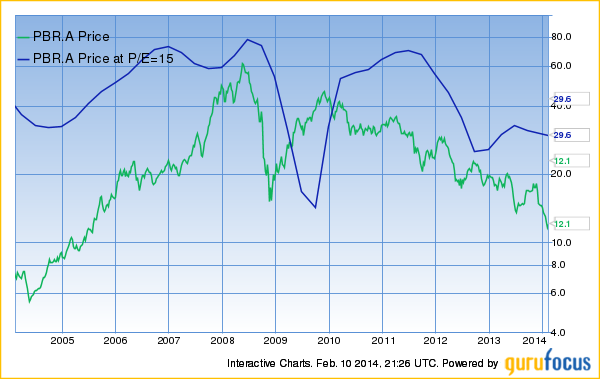

According to the Peter Lynch Chart Petrobras appears to be undervalued:

Petroleo Brasileiro SA Petrobras has a market cap of $79.31 billion. Its shares are currently trading at around $12.16 with a P/E ratio of 5.80, a P/S ratio of 0.50 and a P/B ratio of 0.48. The company had an annual average earnings growth of 10.50% over the past ten years.

Microsoft Corporation (MSFT)

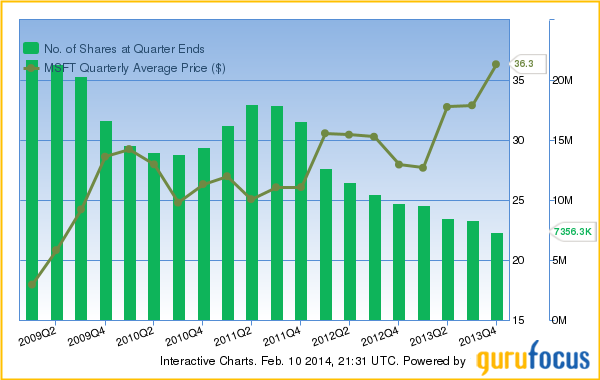

The guru's fourth largest position is in Microsoft where he owns 7,356,300 shares of the company's stock. His position represents 3.4% of his entire holdings as well as 0.09% of the company's shares outstanding.

During the past quarter Brandes dropped -11.6% of his holdings by selling 965,731 shares. He sold these shares for an estimated average quarterly price of $36.32 per share. Since then the price per share has increased approximately 0.7%.

Brandes' historical holding history:

Microsoft develops, manufactures, licenses and supports a wide range of software products and services for many different types of computing devices.

Microsoft's historical revenue and net income:

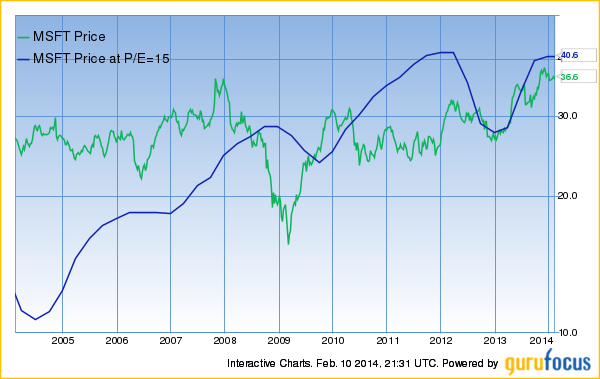

The analysis on Microsoft reports that the company's price is near a 10-year high, its gross and operating margins have been in a 5-year decline and its interest coverage is comfortable, meaning they have enough cash to cover all debt. The company has also shown predictable revenue and earnings growth.

The Peter Lynch chart shows that Microsoft currently appears to be undervalued:

Microsoft has a market cap of $305.47 billion. Its shares are currently trading at around $36.80 with a P/E ratio of 13.60, a P/S ratio of 3.70 and a P/B ratio of 3.57. The company has a dividend yield of 2.70%. The company has also seen average earnings growth of 12.30% over the past ten years.

GuruFocus rated Microsoft the business predictability rank of 3.5-star.

TE Connectivity Ltd. (TEL)

Charles Brandes fifth largest holding is in TE Connectivity where he maintains 4,487,405 shares of the company's stock. The guru's position represents 3.1% of his entire holdings and 1.09% of the company's shares outstanding.

During the fourth quarter Brandes cut his holdings a notable -21.26%. The guru sold a total of 1,211,919 shares of TE in the quarterly price range of $49.91 to $55.11, with an estimated average quarterly price of $52.59 per share. Since then the price per share has increased an additional 7.6%.

Brandes' historical holding history:

TE Connectivity designs and manufactures products involved in electronic connections for industries including automotive, energy and industrial, broadband communications, consumer devices, health care and aerospace and defense.

TE Connectivity's historical revenue and net income:

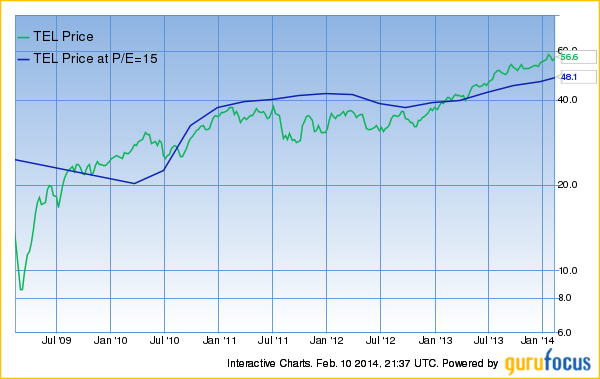

The analysis on TE Connectivity reports that the company's dividend yield is near a 5-year low, its price is near a 10-year high and its revenue has been in decline over the past three years.

The Peter Lynch chart shows that TE currently appears to be overvalued:

TE Connectivity has a market cap of $23.08 billion. Its shares are currently trading at around $56.26 with a P/E ratio of 17.50, a P/S ratio of 1.80 and a P/B ratio of 2.70.

Check out Charles Brandes' complete year-end portfolio here.

Try a free 7-day premium membership trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance