The Battle for Macy's

Macy's Inc. (NYSE:M), with its iconic flagship store in New York City's Herald Square and its beloved Thanksgiving Day Parade, holds a special place in American retail. However, the company has faced significant challenges in recent years, with declining employee count, store count and stock price as it has lost market share to competitors.

To address these challenges, Macy's new CEO Tony Spring has laid out a bold vision, which includes closing underperforming stores and investing in stronger locations, as well as its higher-end Bloomingdale's and Bluemercury chains. The plan calls for closing more than 150 Macy's department stores by 2027, leaving the retailer with approximately 350 locations.

Arkhouse Management is an activist investor that has been pressing to acquire Macy's and take the company private. Arkhouse first made a bid in December 2023 to buy the company at $21 per share. It later launched a proxy fight, putting forward nine nominees to Macy's 15-person board, and raised its bid. The investment firm claims it wants to run Macy's as a retailer and get value out of its real estate, arguing that a private company is better able to achieve long-term viability.

Brigade Capital Management is another activist firm that is partnering with Arkhouse in its mission to acquire Macy's and take it private. The firms claim that a private company would be better positioned to achieve long-term viability, away from the pressures of the public markets.

A recent settlement between Macy's and the two firms has ended the proxy fight for now, but the battle for the department store's future is far from over. As Spring works to execute his turnaround vision, the company still has to decide on the acquisition bid from Arkhouse and Brigade. While interim settlement with Arkhouse has added two independent directors to Macy's board, the activists remain a looming presence. The new directors will join the board's finance committee, tasked with evaluating the acquisition bid and any other offers that may be made.

The real prize is Macy's real estate

The value of Macy's real estate portfolio is estimated to be between $5 billion to $14 billion, compared to its current enterprise value of $10 billion. Investment bank Evercore ISI estimates the retailer's real estate portfolio to be worth $5 billion to $7 billion, with its flagship New York City Herald Square location valued at $900 million to $1.50 billion. TD Cowen, another investment bank, puts the portfolio value at $7.50 billion to $11.60 billion. JPMorgan values the portfolio at $8.50 billion, with the Herald Square flagship alone worth at least $3 billion. In 2015, Starboard valued Macy's real estate at $21 billion, including $3.30 billion for seven downtown properties. In 2022, Cowen assessed Macy's real estate holdings to be worth between $6 billion to $8 billion alone.

These projections indicate Macy's real estate portfolio is a significant asset, with estimates ranging from $5 billion to $14 billion in value. The flagship Herald Square location in New York City is considered particularly valuable, with estimates ranging from $900 million to $3 billion depending on who you ask.

Thus, the primary prize of the activists appears to be the company's valuable real estate portfolio. While Macy's retail business is seen as the icing on the cake, extracting the full value of the real estate will be challenging due to factors like the difficulty of rezoning and converting large retail spaces, high interest rates and the current lack of demand for office space. Department stores have struggled as consumer shopping habits have shifted, with Macy's losing market share to e-commerce and discount retailers. Consumers today want a stronger brand connection and care more about sustainability and labor practices - elements that are difficult for large, generic department stores to communicate effectively. Going private could give Macy's more flexibility to transform, and profitable subsidiaries like Bloomingdale's and Bluemercury could potentially be sold off. However, the track record of real estate investors taking over struggling retailers is not strong, and Macy's could end up a shell of its former self as its real estate and other assets are divested. The future of Macy's is uncertain, but it is unlikely to continue operating as a traditional department store chain. The end of Macy's might well be nigh following the demise of icon's like Sears and JC Penny.

Conclusion

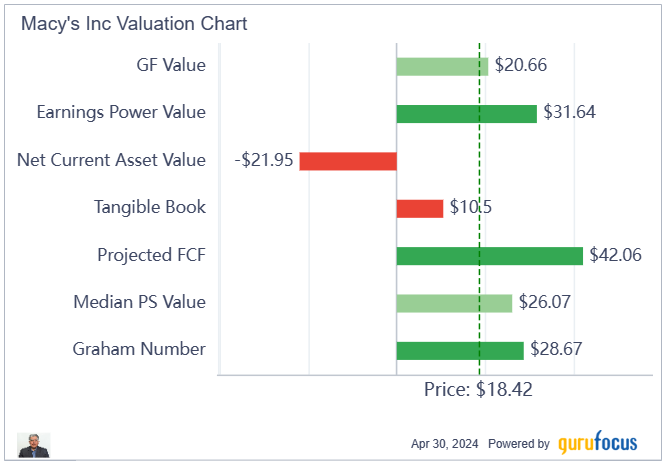

I personally think there is a good chance an agreement may be reached this year at between $25 to $30 a share. At the low end, this represents a 35% premium to the current stock price. Not a bad haul for sitting around a few months. The dividend yield is not too shabby at 3.61%. As Macy's navigates this situation and mulls over its options, the company's future hangs in the balance. We should know by the end of the year if the retailer is going private. The downside to the deal not happening is probably the stock going down to around $15, at least temporirily. With a price-earnings ratio of 6, we are not taking all that much risk.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance