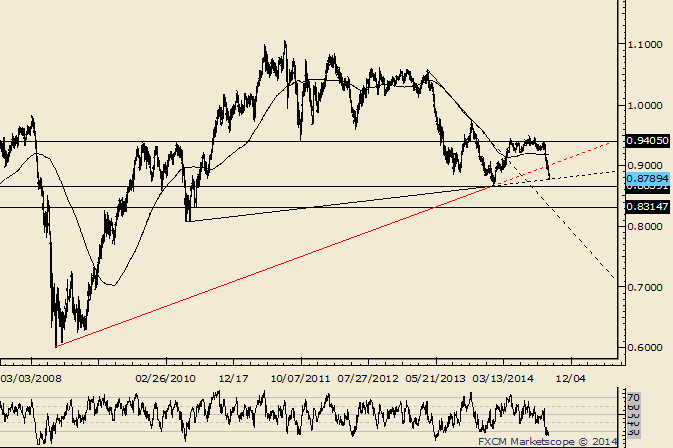

AUD/USD at 5 Year Neckline

DailyFX.com -

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Automate trades with Mirror Trader and see ideas on other USD crosses

-“AUDUSD arguably completed a head and shoulders top today. The pattern’s objective is .8971 but there is possible support from .9135 (2 equal legs down and former highs from March).”

-The target was reached 4 days after the pattern completed but AUDUSD has continued lower since breaking the line that extends off of the 2008 and January lows. That line (in red), is now viewed as resistance if reached near .90. The current level is defined by the line off of the 2010 and January lows. I also have a lot of activity at .8750.

--Tradingideas are availabletoJ.S. Trade Desk members.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance