Aflac (AFL) to Acquire 40% Stake in Tree Line Capital for $100M

Aflac Incorporated AFL is set to acquire a 40% stake in a private credit asset management firm, Tree Line Capital Partners, per The Wall Street Journal. With this move, AFL is likely to capitalize on the thriving private credit market.

Aflac is set to buy the stake in Tree Line Capital for a price tag of $100 million from Tree Line's private equity investor, Stone Point Capital, and Tree Line's management. Per the deal, Aflac intends to fund Tree Line using a portion of the investible cash generated from insurance premiums over a multi-year period.

The agreement reflects the insurance companies' emphasis in general on generating consistent returns for their policyholders and actively seeking opportunities to efficiently deploy their cash holdings.

Direct lender Tree Line Capital specializes in serving small and medium-sized companies. Aflac is poised to reap the rewards of high returns from private credits within this space. It is expected to gain from both the growth of Tree Line and its dividend distributions.

Aflac has a significant presence in two major countries: the United States and Japan. Its U.S. business has been consistently performing well, attributed to growth investments and productivity gains. The post-pandemic recovery in the U.S. economy has greatly benefited Aflac's U.S. unit in recent years.

Factors such as product innovations, the introduction of new offerings, the expansion of virtual sales channels, increased face-to-face interactions, and the recruitment of high-quality agents are driving its sales growth.

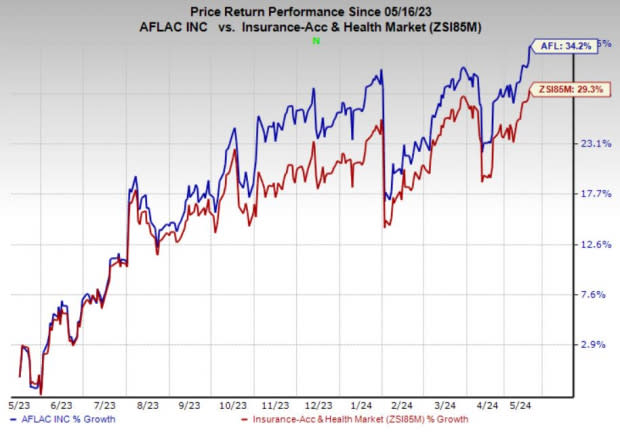

Price Performance

Shares of Aflac have jumped 34.2% in the past year compared with the 29.3% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Aflac currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Finance space are Ambac Financial Group, Inc. AMBC, Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ambac Financial’s current-year earnings is pegged at $1.45 per share, which witnessed one upward estimate revision in the past month against no movement in the opposite direction. AMBC beat earnings estimates in all the past four quarters, with an average surprise of 893.5%.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed six upward estimate revisions against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 35.6% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance