AbbVie (ABBV) Beats on Q1 Earnings & Sales, Ups '24 EPS View

AbbVie Inc. ABBV reported adjusted earnings of $2.31 per share for first-quarter 2024, beating the Zacks Consensus Estimate of $2.26. The reported earnings also exceeded the guidance of $2.18-$2.22. However, earnings declined 6.1% year over year.

ABBV’s revenues of $12.31 billion beat the Zacks Consensus Estimate of $11.99 billion. Sales rose 0.7% year over year on a reported basis and 1.6% on an operational basis. The upside can be attributed to a rise in product sales of key drugs like Rinvoq, Skyrizi, Venclexta and Vraylar, partially offset by declining sales of Humira and Imbruvica.

All growth rates mentioned below are on a year-on-year basis and at constant exchange rates (CER).

Quarter in Detail

In immunology, AbbVie’s flagship drug, Humira, recorded a year-over-year sales decline of 35.2% to $2.27 billion. Sales in the United States declined 39.9% to $1.77 billion, while ex-U.S. market sales were down 11.6% on an operating basis to $499 million. The drug’s sales beatthe Zacks Consensus Estimate and our model estimates of $2.23 billion and $2.24 billion, respectively.

This substantial decline in Humira sales was due to the drug’s loss of exclusivity in the United States since last year. The drug lost its exclusivity in ex-U.S. territories following the launch of generics in 2018.

Net revenues from Rinvoq in the first quarter were $1.09 billion, up 61.9%. The upside can be attributed to label expansions to the drug to include new patient populations in recent quarters. Rinvoq sales beat the Zacks Consensus Estimate and our model estimates of $1.05 billion and $1.00 billion, respectively.

Net revenues recorded from Skyrizi were $2.01 billion, up 48.0%. This uptick in sales is due to label expansions to the drug to include new patient populations in recent quarters. Skyrizi sales beat both the Zacks Consensus Estimate of $1.97 billion and our model estimates of $1.93 billion.

Sales from the neuroscience portfolio increased 16.0% to $1.97 billion, driven by higher sales of the depression drug Vraylar and migraine drugs Ubrelvy and Qulipta. Neuroscience sales figures beat the Zacks Consensus Estimate and our model estimate of $1.93 billion and $1.95 billion, respectively.

While Botox Therapeutic sales rose 4.5% to $748 million, sales of Vraylar increased 23.6% to $694 million. Sales of AbbVie’s oral migraine drug Ubrelvy were $203 million, up 33.8% year over year.

The recently-launched Qulipta generated $131 million in product revenues compared with $114 million in fourth-quarter 2023.

AbbVie’s oncology/hematology sales rose 9.8% to $1.54 billion in the quarter, as sales from the recently acquired ovarian cancer drug Elahere and rising Venclexta sales more than offset the declining Imbruvica sales. The oncology/hematology sales figure significantly beat the Zacks Consensus Estimate of $1.35 billion and our model estimate of $1.37 billion.

First-quarter net revenues from Imbruvica were $838 million, down 4.5%. However, sales of the drug were better than the Zacks Consensus Estimate of $728 million and our model estimate of $722 million.AbbVie markets this drug in partnership with Johnson & Johnson JNJ.

U.S. sales of J&J-partnered Imbruvica declined 4.3% to $610 million. Sales of the J&J-partnered Imbruvica declined amid rising competition from novel oral treatments in the United States. AbbVie shares international profits earned from Imbruvica with J&J. The company’s share of profit from the international sales of the drug declined 5.1% to $228 million.

AbbVie’s leukemia drug Venclexta generated revenues of $614 million in the reported quarter, reflecting 16.3% growth. AbbVie markets Venclexta in collaboration with Roche RHHBY. The Roche-partnered drug beat the Zacks Consensus Estimate and our model estimate, both of which were pegged at $579 million.

In February, management completed the acquisition of ImmunoGen following which it added ovarian cancer drug Elahere to its portfolio. Since adding the drug, Elahere generated revenues of $64 million in the quarter, beating our model estimate of $50 million.

The company recorded sales worth $27 million from the recently launched lymphoma drug Epkinly/Tepkinly, which is marketed in partnership with Genmab GMAB. AbbVie shares U.S. profits earned from Epkinly with Genmab. The company’s share of profit from U.S. sales was $12 million.

AbbVie’s aesthetics portfolio sales were down 2.5% to $1.25 billion. Sales of Botox Cosmetic sales lost 2.6% to $633 million, while Juvederm sales fell 13.7% to $297 million.

Eye care portfolio sales declined 10.4% to $538 million. Sales of Ozurdex, a key drug in the portfolio, rose 14.6% to $131 million.

Cost Discussion

Adjusted SG&A expenses rose 1.6% to $3.03 billion, while adjusted R&D expenses were $1.81 billion in the first quarter, up 9.3% year over year. The adjusted operating margin contributed 42.2% to sales.

2024 Guidance Raised

AbbVie raised its earnings per share (“EPS”) guidance for 2023. The company expects adjusted EPS in the range of $11.13-$11.33, up from the previously provided EPS guidance of $10.97-$11.17.

Our Take

AbbVie’s first-quarter results were better than expected, with the top and the bottom line beating the consensus mark. The company also raised its EPS guidance for 2024, which we expect was likely due to the better-than-expected sales performance of Skyrizi during the quarter. Despite declining sales due to stiff competition, the reported Humira and Imbruvica sales were better than expectations.

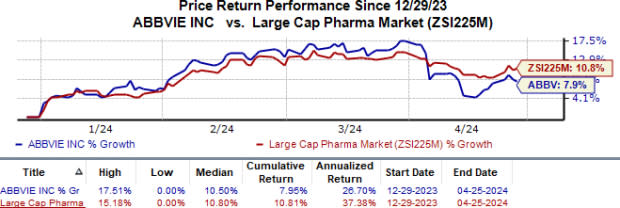

Post the earnings announcement, shares were up 1.2% in pre-market trading. In the year so far, shares of AbbVie have risen 8.0% compared with the industry’s 10.8% rise.

Image Source: Zacks Investment Research

Management’s efforts to strengthen the company’s oncology portfolio are also showing promise. Despite recording just a partial quarter of Elahere product sales, the reported figures beat our estimates. Elahere is the first and the only antibody-drug conjugate (ADC) approved for ovarian cancer indication.

Management also intends to strengthen its oncology pipeline. In this regard, it entered into agreements with companies like Umoja Biopharma and Tentarix Biotherapeutics to explore different modalities, like cell therapy and multi-functional biologics, to identify new treatment approaches.

AbbVie’s neuroscience products have also been showing robust performance, being driven by sales of the recently approved migraine drugs Qulipta and Ubrelvy. Through these new product launches, AbbVie expects to return to robust revenue growth in 2025 with a high single-digit CAGR through the end of the decade.

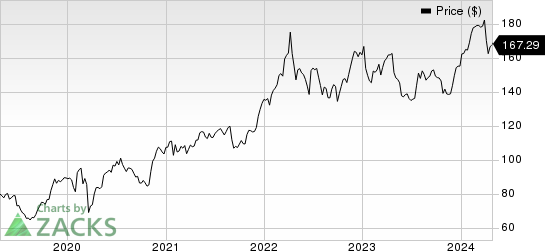

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank

AbbVie currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Genmab A/S Sponsored ADR (GMAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance