3 Consumer Loan Stocks to Buy From a Prospering Industry

The Zacks Consumer Loans industry continues to witness deteriorating asset quality. The industry players are also bearing the brunt of persistent inflation, higher interest rates and expectations of economic slowdown.

Yet, as consumers understand that high interest rates are here to stay for a long time, demand for consumer loans is likely to improve gradually. Easing lending standards, stabilizing consumer sentiments and the digitization of operations will keep aiding consumer loan providers. Hence, industry players like Mr. Cooper Group Inc. COOP, World Acceptance Corporation WRLD and EZCORP, Inc. EZPW are worth considering right now.

About the Industry

The Zacks Consumer Loans industry comprises companies that provide mortgages, refinancing, home equity lines of credit, credit card loans, automobile loans, education/student loans and personal loans, among others. These help the industry players generate net interest income (NII), which forms the most important part of total revenues. Prospects of the companies in this industry are highly sensitive to the nation’s overall economic condition and consumer sentiments. In addition to offering the above-mentioned products and services, many consumer loan providers are involved in other businesses like commercial lending, insurance, loan servicing and asset recovery. These support the companies in generating fee revenues. Furthermore, this helps the firms diversify revenue sources and be less dependent on the vagaries of the economy.

3 Themes Influencing the Consumer Loan Industry

Loan Demand Stabilizing: The persistently high inflation and other macroeconomic headwinds continue to weigh on consumer sentiments. The Conference Board Consumer Confidence Index declined in April. But the index has remained within the “narrow range that’s largely held steady for more than two years.”

Dana M. Peterson, Chief Economist at The Conference Board said, “Despite April’s dip in the overall index, since mid-2022, optimism about the present situation continues to more than offset concerns about the future.” This will thereby result in decent demand for consumer loans in the near term. Thus, growth in net interest margin (NIM) and NII for consumer loan companies is likely to be stable.

Easing Lending Standards: With the nation’s big credit reporting agencies removing all tax liens from consumer credit reports since 2018, several consumers' credit scores have improved. This has raised the number of consumers for the industry participants. Further, easing credit lending standards is helping consumer loan providers meet loan demand.

Asset Quality Weakening: For the major part of 2020, consumer loan providers built additional provisions to tide over unexpected defaults and payment delays due to the economic downturn resulting from the COVID-19 mayhem. This considerably hurt their financials. However, with solid economic growth and support from government stimulus packages, industry players began to release these reserves back into the income statement.

Now again, the current macroeconomic headwinds, including expectations of economic downturn, will likely curtail consumers’ ability to repay loans. Thus, consumer loan providers are building additional reserves to counter any fallout from unexpected defaults and payment delays. This is leading to a deterioration in industry players’ asset quality, and several credit quality metrics have crept up toward pre-pandemic levels.

Zacks Industry Rank Reflects Bright Picture

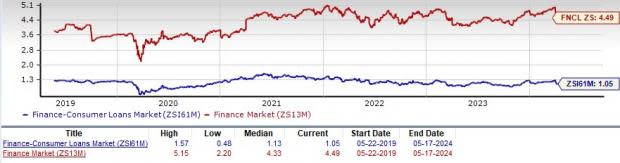

The Zacks Consumer Loans industry is a 16-stock group within the broader Zacks Finance sector. The industry currently carries a Zacks Industry Rank #50, which places it in the top 20% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of an encouraging earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Over the month, the industry’s earnings estimates for 2024 have moved marginally upward.

Before we present a couple of stocks that you may want to bet on, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry vs. Broader Market

The Zacks Consumer Loans industry has outperformed both the Zacks S&P 500 composite and its sector over the past year.

The stocks in this industry have collectively jumped 35.9% over this period, while the Zacks S&P 500 composite and the Zacks Finance sector have rallied 26.6% and 26%, respectively.

One-Year Price Performance

Industry Valuation

One might get a good sense of the industry’s relative valuation by looking at its price-to-tangible book ratio (P/TBV), commonly used for valuing consumer loan stocks because of significant variations in their earnings results from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 1.05X, below the median level of 1.13X, over the past five years. This compares with the highest level of 1.57X and the lowest level of 0.48X over this period. The industry is trading at a considerable discount when compared with the market at large, as the trailing 12-month P/TBV ratio for the S&P 500 is 11X and the median level is 10.32X.

Price-to-Tangible Book Ratio (TTM)

As finance stocks typically have a lower P/TBV, comparing consumer loan providers with the S&P 500 may not make sense to many investors. However, a comparison of the group’s P/TBV ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector’s trailing 12-month P/TBV of 4.49X for the same period is way above the Zacks Consumer Loan industry’s ratio, as the chart below shows.

Price-to-Tangible Book Ratio (TTM)

3 Consumer Loan Stocks Worth Investing

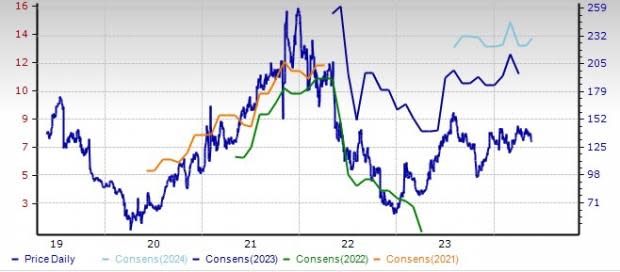

Cooper Group: Headquartered in Coppell, TX, the company is engaged in non-banking services for mortgage loans. The company operates through its primary brands — Mr. Cooper and Xome.

Though the demand for mortgages is subdued now due to higher rates, COOP is well-placed to leverage its scale (it is one of the largest non-bank mortgage servicers in the United States) and bolster its top-line growth. Further, the strategic acquisitions of Home Point Capital Inc. and Roosevelt Management Company, LLC in 2023 will boost the company’s servicing business.

With the Federal Reserve likely to keep interest rates high in the near term to control inflation, this Zacks Rank #1 (Strong Buy) company’s NII and NIM are expected to witness improvements, though rising funding costs will weigh on both. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for earnings for 2024 and 2025 has moved 5.2% and 5% upward, respectively, over the past 30 days. Also, COOP shares have jumped 40.4% over the past six months.

Price and Consensus: COOP

World Acceptance: This Zacks Rank #2 (Buy) company operates a small-loan consumer finance (installment loan) business. This Greenville, SC-based company operates through more than 1,000 branches across 16 states.

WRLD majorly generates revenues from interest and fee income on its pre-computed and interest-bearing consumer installment loans. Driven by steady demand for consumer loans, the metric is expected to keep improving in the quarters ahead.

Also, World Acceptance has a share repurchase plan in place. In November 2023, the company expanded its share buyback plan to $20 million. Given the decent liquidity position, share repurchases seem sustainable.

Over the past six months, World Acceptance shares have gained 16.4%. The Zacks Consensus Estimate for earnings for fiscal 2025 has moved 3.6% upward over the past 30 days.

Price and Consensus: WRLD

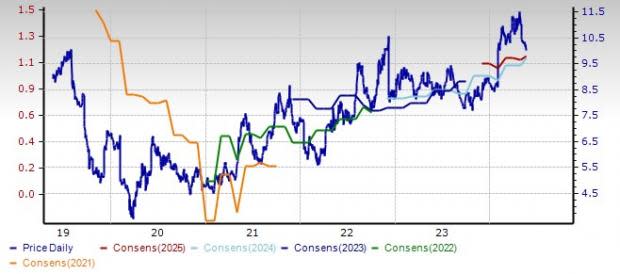

EZCORP: This Zacks Rank #2 stock provides pawn services in the United States and Latin America. Based in Austin, TX, the company is a leading provider of pawn transactions and a seller of pre-owned and recycled merchandise.

EZPW remains focused on optimizing its balance of pawn loans outstanding, which results in higher pawn service charges (PSC). Driven by this, the company’s PSC has been improving, with almost 37% of revenues coming from there. As of Mar 31, 2024, EZCORP had more than 1,235 stores across its footprint. As part of its strategy, the company intends to further expand through both acquisitions and de novo openings.

Further, the company has a share repurchase plan in place. Given the decent liquidity position, share repurchases seem sustainable.

EZCORP shares have rallied 20.9% over the past six months. Over the past 30 days, the Zacks Consensus Estimate for earnings has been revised 5.7% and 2.7% north for fiscal 2024 and fiscal 2025, respectively.

Price and Consensus: EZPW

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MR. COOPER GROUP INC (COOP) : Free Stock Analysis Report

World Acceptance Corporation (WRLD) : Free Stock Analysis Report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance