Netflix can't keep growing like this — can it?

Everyone you know loves Netflix (NFLX), the world’s largest online video service.

Well, okay, not everyone.

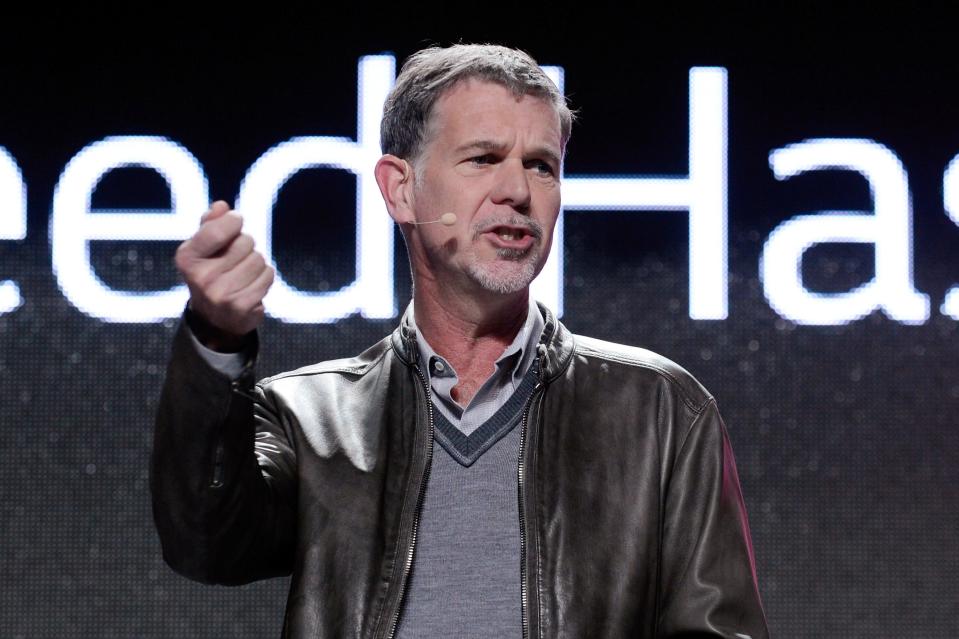

Netflix just reported that it reached 31.7 million paying customers at the end of 2013. That's more than any of its cable competitors such as HBO (29 million), Showtime (23 million) and Starz (22 million), according to figures fron SNL Kagan. But Netflix CEO Reed Hastings has said he wants to reach as many as 90 million U.S. customers. That’s nearly as many households as subscribe to cable television in total and a few million more than have broadband Internet service in the most recent Census figures.

Can he do it?

Reasons to question growth

There’s no questioning Hastings' incredible success in transforming the company’s focus from renting DVDs to streaming online video. And the population is increasing while more people than ever are going online, especially with their mobile phones. But there are several reasons to question just how much further Netflix can grow.

The challenges aren't obvious yet. Netflix added another 2.3 million U.S. subscribers in the fourth quarter, more than analysts expected, the company said on Wednesday. That sent the stock up 15% after hours.

So start with the reason why anyone subscribes to Netflix: great content. The problem is it’s going to get more expensive to obtain great content, either by licensing it from Hollywood studios or paying to produce it directly. Netflix has to bid against Amazon (AMZN) and Hulu for online streaming rights and, as old deals expire, it looks like the quality of Netflix offerings is declining. And that’s forcing Netflix to shift from being an endless library of great stuff, as it was in the DVD-focused era, to a more limited highlight reel of fewer great things, like a premium cable channel.

Consider the movies Netflix lost the rights to stream at the end of 2013 versus the movies Netflix gained. Gone are easily recognizable favorites such as "Titanic," "Top Gun" and "Braveheart." New arrivals consist of far less exciting fare such as "Hansel & Gretel: Witch Hunters" and "Jack Reacher," a Tom Cruise box office bomb from 2012. True, those using the DVD service haven't lost any content, but there are currently less than 7 million customers using Netflix's DVD service.

The losses generate bad publicity, as thousands of Netflix fans take to Twitter (TWTR) and Facebook (FB) to bemoan the removal of their favorites. And they shrink the potential audience for new subscribers looking to watch their top picks.

The original-content business

Partly to offset those losses, Netflix has gotten into the original content business, producing some critically acclaimed shows last year, including "House of Cards" and "Orange is the New Black." But those shows cost far more than licensed content – Netflix paid $100 million for 26 episodes of the "House of Cards" political drama (which made streaming-content history by picking up three statues at the 2013 Emmy awards).

And competition for great original programming is heating up as well. It must be one of the greatest times ever to be pitching a new television show. Amazon is developing its own slate of originals as is Hulu. HBO and Showtime aren’t slowing down and over at Starz, former HBO programming whiz Chris Albrecht is also turning to producing more originals, with new pirate show “Black Sails” getting a lot of early, positive press. At some point, the whole industry will reach a point of diminishing returns, as viewers struggle to fit so many quality programs into their limited viewing hours.

But perhaps the most significant problem with using your own hit shows to attract subscribers is that not every show is a hit. HBO found this out after "Sex and the City" and "The Sopranos" went off the air. Absent compelling new shows, subscriber growth stalled for several years.

To be sure, there are no signs that current Netflix customers are having trouble finding things to watch yet. Subscribers watched a record 5 billion hours of shows and movies in the third quarter of 2013, up from 4 billion in the first quarter. Content problems won’t be apparent until the amount of viewing per subscriber levels off or starts declining. And Netflix will have a lot more to show in coming years from some of its more recent deals with the likes of Disney (DIS), Dreamworks Animation (DWA) and Marvel Comics.

Still, streaming 5 billion hours worth of entertainment takes up a lot of Internet bandwidth. And that’s another challenge facing Netflix. So far, the company has paid for its own Internet access to send out its shows, and subscribers have paid for their connections at home. But an appeals court this month struck down federal rules that maintained that dynamic. That means Internet service providers may seek to charge Netflix extra to reach its customers.

The end of so-called net neutrality could be very costly for Netflix and other streaming providers, especially since they compete with the cable TV offerings of many of the largest ISPs.

Making the situation worse, Hastings has been touting Netflix's ability to offer super-high definition programming using a new standard called 4K. But it takes a huge amount of bandwidth to send 4K programming down the wire, more than the average Internet user has on tap. Becoming even more of a bandwidth hog just as the regulatory environment shifts to favor bandwidth providers looks like a losing strategy.

Another challenge for Hastings is Netflix's sky-high share price. Investors pushed shares up from $93 to over $368 last year, even prompting a warning from Hastings that he was worried the price had gotten ahead of the company’s value. The shares had sold off, but if after-hours trading prices on Wednesday hold, the stock could exceed its all-time high and even reach $400. That's more 216 times the company’s profits last year, an astronomical level compared to the market’s overall ratio of less than 20 times profit.

If Netflix falters on its subscriber growth or viewership stats for a quarter or two, those same investors may overreact in the opposite direction, sending the stock price tumbling. That in turn would distract management and could put pressure on the company to rein in some of its expansion plans.

It was just under three years ago that Hastings sent the share price crashing with an ill-conceived plan to split the company in two and raise prices. Netflix fans and investors alike hope he’ll better navigate the challenges this time around.

Yahoo Finance

Yahoo Finance