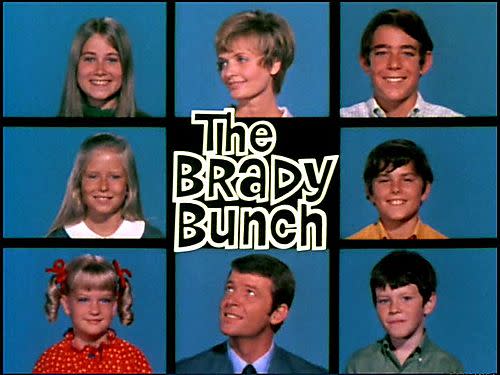

Blended family finances: Where to start

America's most well known blended family. Carol Brady, a divorcee, and Mike Brady, a widower, met and married and introduced the world to a functional blended family...and Alice, who just plain rocks.

Gina DeBrincat describes her family not so much as blended, but rather, pureed.

The Winnipeg life coach has a stepdaughter from her first marriage; had two kids with her second husband, who left them; and is now happily married to a man with one son.

The author of The Matrix of the Blended Family knows first-hand that out of the many challenging issues that people in similar situations must deal with, money is right up there.

“We amalgamated our finances and our family and our children as an organic family,” DeBrincat says. “I don’t know how common that is; it’s so selective. The parents in any particular household have to decide what they’re comfortable with. There are so many variables in terms of parents’ and stepparents’ cooperation and involvement in their kids’ lives. There’s no panacea.”

When you start factoring in alimony, living expenses, and the cost of multiple kids’ tuition, the numbers become sobering. Fifty-five per cent of blended families in the U.S. say they live pay-cheque-to-pay-cheque, while 30 per cent cite one of their worst financial habits as not saving any money, according to a recent study by U.S. financial services firm Allianz.

The study also found that blended families average $158,600 in savings and investable assets compared to $264,300 for nuclear families.

Plan early

Although it may seem like a daunting task, it’s important for blended families to figure out finances from the get-go.

“You’re best advised to consult both a financial advisor and a family law specialist,” says Cynthia Caskey, vice president of portfolio management and sales, TD Waterhouse Private Investment Advice in Toronto. “Our research indicates that more than two-thirds of Canadians who are blending their families don’t.

“Think of it like this: have you ever put together a puzzle without the picture as a guide? It can be difficult and time consuming, and there may be a need to backtrack,” she adds. “Advice is critical … because some of your decisions can have long-term and costly implications if you aren’t aware of the pitfalls.”

Nepean Investors Group Financial Services consultant Michelle White says like all couples, those in blended families need to talk about their philosophies behind money before getting to the nitty-gritty.

“Do they each have similar savings patterns?” White asks.

“Have they created a budget or a new financial plan together? Do they approach saving and spending money in the same way?…It is necessary to balance the needs of the previous spouse, current spouse, children of previous relationship and children of current relationship?” he asks.

Because of the potentially complex legal issues involved, couples may want to consider a domestic contract or pre-nuptial agreement before they walk down the aisle and a cohabitation agreement if they decide to move in together first.

Think longterm first

While most people focus on day-to-day finances and paying the bills in the early stages of blending families, the long term should be considered from the outset.

“There is so much more at stake in terms of the bigger picture of ensuring there is a safety net in place in case of illness or loss of employment, how to save for and pay for education of their children, as well as ultimately retirement and other long-term goals which are investment-related,” Caskey says.

Among the more complex aspects blended families need to work out is estate planning, including power of attorney, direct beneficiary designations, spousal trusts, insurance, heirloom items, guardianship, and funeral arrangements, White says, noting that family law varies from province to province.

“I cannot stress the importance of seeking legal advice in these matters,” White says. “In many jurisdictions if there’s a will, but people get remarried, the marriage will render any previous wills void, except in Quebec.

So if they’ve named their children from their previous relationship as beneficiaries, and they remarry, that will has no effect. Even if they do change their will to reflect the new circumstance but make no provision for the new spouse, that spouse may still have a claim under the family property application.”

Whether income and expenses are shared evenly or spouses make an arrangement where each pays for things like tuition individually, DeBrincat emphasizes the need to handle those discussions with care.

“If it’s going to be ‘you look after your kids, I’ll look after mine,’ this isn’t a conversation for kids to hear,” DeBrincat says. “You need to look at the kids’ point of view and the parents’ point of view. It’s extremely important for this discussion prior to marriage or cohabitation. I would rather have an uncomfortable decision now than have a conversation that turns into a raging fight five years down the road.”

Yahoo Finance

Yahoo Finance