Gazprom swings to £5bn loss in blow to Putin

Kremlin-owned natural gas giant Gazprom has plunged to its worst loss in at least 25 years in a blow to Vladimir Putin’s war economy.

The energy company, which is majority owned by the Russian government, tumbled to a loss in of a loss of 629 billion roubles (£5.5bn) in 2023 after making a profit of 1.2 trillion roubles I the previous year.

The energy giant’s shares in Moscow were down around 3.3pc after revealing the downturn, which was far steeper than the 447 billion rouble (£3.9bn) losses predicted by analysts, according to Interfax news agency.

It had made a profit of 1.2 trillion roubles (£10.4bn) in 2022.

Largely owned by the Kremlin, Moscow-based Gazprom is Russia’s largest oil and gas company.

A number of the company’s top executives have been sanctioned by the UK government since Russia’s invasion of Ukraine, including chief executive Alexei Miller.

Russia’s gas exports to Europe, once its primary export market, have fallen sharply, making Gazprom the most tangible victim of Western sanctions against Putin’s regime.

The company said it sustained a net loss of 364bn roubles from sales in 2023, in contrast to a profit of 1.9 trillion roubles in 2022.

Its total revenue fell to 8.5 trillion roubles last year from 11.7 trillion in 2022.

Gazprom has not published its own export statistics since the start of 2023.

It has been trying to reduce its dependency on Europe by increasing its supplies through its gas pipeline from Siberia to China.

The gas producer has been struggling to persuade China to sign a new deal for an additional, 1,700-mile pipeline to boost those exports, although Mr Putin suggested it would be the “deal of the century”.

Read the latest updates below.

06:00 PM BST

That’s all for today...

Thanks for joining us on the Markets blog today. We’ll be back in the morning to keep you informed of the latest from the City and beyond.

05:58 PM BST

That’s all for today...

Thanks for joining us on the Markets blog today. We’ll be back in the morning to keep you informed of the latest from the City and beyond.

05:57 PM BST

Wind farm operator warns over high interest rates

The operator of 12 British wind farms has warned that high interest rates will keep the costs of renewable energy elevated, according to an FT report.

Mads Nipper, the boss of Ørsted, warned that: “The longer interest rates stay high, the longer prices in [renewable energy] auctions will stay high ... We expect and hope they will come down.”

Ørsted, which runs the world’s largest offshore wind farm in the North Sea, known as Hornsea 2, employs 6,000 people in the UK.

05:42 PM BST

ITV hit by revolt over chief Carolyn McCall’s pay deal

ITV has been hit by a shareholder backlash over a £2.9m pay packet for its chief executive as the broadcaster grapples with a sharp slump in advertising. James Warrington reports:

Almost a fifth of votes at ITV’s annual general meeting on Thursday were cast against the company’s pay report for 2023.

Dame Carolyn McCall took home £2.9m last year, down around 22pc from her £3.5m pay packet in 2022 after a fall in her bonus.

But the remuneration has still angered some investors as the Love Island broadcaster faces a tough backdrop.

ITV has embarked on a cost-cutting plan after its advertising revenues tumbled 15pc last year. Dame Carolyn said it was “too early to say” whether the plans would lead to job cuts.

In its annual report, ITV said: “Although we are mindful of the diverse views of our investors, we have opted to retain the current pay approach as it continues to support our strategy.”

05:19 PM BST

Turkey blocks all trade with Israel, reports say

Turkey has stopped all trade with Israel as of today, according to reports.

Bloomberg said news of the block had come from two Turkish officials familiar with the matter. It follows last month’s restrictions on some exports.

The move drew a furious response from Israel’s foreign minister.

.@RTErdogan is breaking agreements by blocking ports for Israeli imports and exports. This is how a dictator behaves, disregarding the interests of the Turkish people and businessmen, and ignoring international trade agreements. I have instructed the Director General of the…

— ישראל כ'ץ Israel Katz (@Israel_katz) May 2, 2024

05:13 PM BST

Continental farmers could receive ‘temporary crisis’ cash in EU move

The EU will allow member states an extra six months of loose rules over farm subsidies to support the region’s agricultural sector following protests from farmers seeking better pay and working conditions.

Farmers across Europe have demonstrated against increasing regulation placed upon them by the EU’s green agenda, which they say has driven up costs, as well as what they see as unfair competition from foreign imports, particularly from Ukraine.

The European Commission said on Thursday that its decision to extend the Temporary Crisis and Transition Framework (TCTF), which also applies to the fishing sector, means member states have more leeway to offer financial support until December 31.

EU members will be able to provide up to 280,000 euros ($299,040) per firm for agricultural companies affected by market disturbance, including sanctions, and up to 335,000 euros in the fisheries sector.

05:05 PM BST

American stocks rise after Fed calms fears of rate hike

Wall Street continued to push higher this afternoon after markets swung to a mixed finish a day earlier after news that the US Federal Reserve was delaying cuts to interest rates.

The S&P 500 and the Dow Jones Industrial Average are both up around 0.5pc. Nasdaq is up 0.9pc.

Yesterday, Federal Reserve chair Jerome Powell said it will likely take “longer than previously expected” to get confident enough to cut rates, a move that would ease pressure on the economy and investment prices.

At the same time, Mr Powell said it was unlikely that a rate hike was coming at the Fed’s next policy meeting in June, calming fears swirling in the market.

Traders themselves had already downshifted their expectations for rate cuts this year to one or two, if any, after coming into the year forecasting six or more.

04:56 PM BST

Footsie closes up

The FTSE 100 closed up 0.6pc today. The biggest riser was banking giant Standard Chartered, up 8.8pc, followed by packaging company Smurfit Kappa, up 5.8pc. The biggest faller was hotel group Whitbread, down 3.2pc, followed by insurer Beazley, down 3pc.

Meanwhile, the FTSE 250 rise a similar 0.6pc. The top riser was Trustpilot, up 6.7pc, followed by investment manager Foresight Group, up 6.4pc. The biggest faller was Bank of Georgia, down 6pc, followed by TBC Bank, down 5.5pc.

04:52 PM BST

Android and iPhone chip supplier jumps 9pc

Shares in American chip giant Qualcomm are up 9pc after it issued investors with a sales and profit forecast that was bigger than Wall Street expectated, driven by selling more and pricier chips into Android smartphones with artificial-intelligence features.

After a smartphone slump last year, Qualcomm said that China’s Android market - which has become critical to the company - has started to pick up, with consumers there shifting toward purchasing higher-priced devices that can accommodate AI chatbots.

The company said its sales to Chinese smartphone makers have grown 40pc in the first half of its financial year, a sign of recovery in that market.

Qualcomm has faced competition from Huawei, which last year introduced a flagship 5G smartphone that uses its own chip made by subsidiary HiSilicon. But IDC analyst Phil Solis said that, for the moment, it appears that a general trend toward more capable devices is helping Qualcomm more than Huawei’s competition is hurting the US company.

04:45 PM BST

Coutts pulls £2bn out of London stock market

The King’s bank is pulling nearly £2bn out of the London stock market in the latest hammer blow to the beleaguered exchange. Michael Bow reports:

Coutts, which banks the Royal family and operates an ATM in Buckingham Palace, has announced plans to move away from UK stocks and instead invest its money abroad.

The changes will see the amount it invests in UK equities drop from 33pc of assets to just 2pc, meaning Coutts will sell £1.96bn of British stocks and plough the money into other regions.

Coutts said the changes would help it “achieve the best returns for our clients in the most attractive markets”.

The decision by one of Britain’s most iconic banks to shun the London Stock Exchange is yet another blow for the troubled market.

04:14 PM BST

Pint-sized wine bottles to be legal from September

Pint-sized wine bottles favoured by Sir Winston Churchill will once again be legal from September 19 after calls from the wine trade.

Berry Bros and Rudd, the family business which supplies wine to the King, had called for the introduction of the bottle size, which had been prohibited by under EU rules, while champagne house Pol Roger had said the pint size was an “opportunity”.

Simon Berry, told Drinks Business shortly after the Brexit vote in 2016:

I’ve been campaigning to bring back the imperial pint for over 30 years and until recently I was no closer to winning this battle - but perhaps recent events will change that.

The imperial pint makes for a perfect-sized bottle. You get four proper-sized glasses from it - as opposed to six from a bottle, or three from a half-bottle. Champagne is designed to be shared, ideally with one other person. The imperial pint gives two drinkers a couple of glasses each when a half-bottle would seem mean and a bottle lavish.

04:01 PM BST

French Chardonnay crops ravaged after huge hailstones hit vines

A violent hailstorm ravaged vineyards yesterday in Chablis in the French region of Burgundy, with large hailstones slicing off leaves and damaging vines, winemakers said today.

The full extent of the damage caused to the Chardonnay vineyards remains unclear but winemaker Laurent Pinson said his most badly damaged vineyards had suffered losses of around 85pc-90pc while others were at around 20pc-25pc. He said:

Our morale is at rock bottom. We are losing our harvest on the affected plots and although there will be a harvest, it will only be a small one. What is destroyed is destroyed.

Another winemaker in Chablis, Julie Fevre, stressed that the hailstorm had only lasted a few minutes. “We’ve never seen anything like this, it’s dramatic,” she told BFM TV.

French Agriculture Minister Marc Fesneau said on the social media platform X that authorities were trying to assess what kind of support they could offer to the Chablis wine growers.

03:42 PM BST

Aldi sales growth stalls as cost-of-living pressures ease

Aldi’s sales growth is starting to stall after months of strong momentum as cost-of-living pressures ease. Retail Editor Hannah Boland reports:

The discount supermarket saw its market share slip to 10.4pc in the 12 weeks to April 20, down from 10.8pc in the same period a year earlier, according to NIQ Total Till figures.

Sales rose by 1.3pc over the period, making Aldi the third slowest growing grocer ahead of only Asda and the Co-op.

Rival Lidl’s sales grew by 9.5pc over the period, while Marks & Spencer recorded sales growth of 9.3pc and Ocado 12pc.

The slowdown at Aldi comes as inflationary pressures start to ease.

During the height of the cost-of-living crisis, Aldi’s sales were rising by more than 20pc year-on-year as cash-strapped shoppers sought out better value.

However, price pressures have eased significantly over the last year. Inflation has fallen from a peak of 11.1pc in October 2022 to 3.2pc in March.

Wages began rising faster than inflation in October last year for the first time in almost two years.

Around half of all households now feel their finances are in a better position than they were at the end of last year, NIQ said. Mike Watkins, NIQ’s UK head of retailer and business insight, said many of this group were likely to “start to spend more freely in 2024”.

Sainsbury’s and Tesco both drew more shoppers in the 12 weeks to April 20, according to NIQ, while Morrisons is now holding its market share.

Asda’s market share dipped to 12.6pc in the 12 weeks to April 20, down from 13.3pc a year earlier. Sales fell 0.9pc over the period on a year-on-year basis.

03:36 PM BST

Handing over

That is all from me today but the live updates will keep coming into the evening, courtesy of my colleague Alex Singleton.

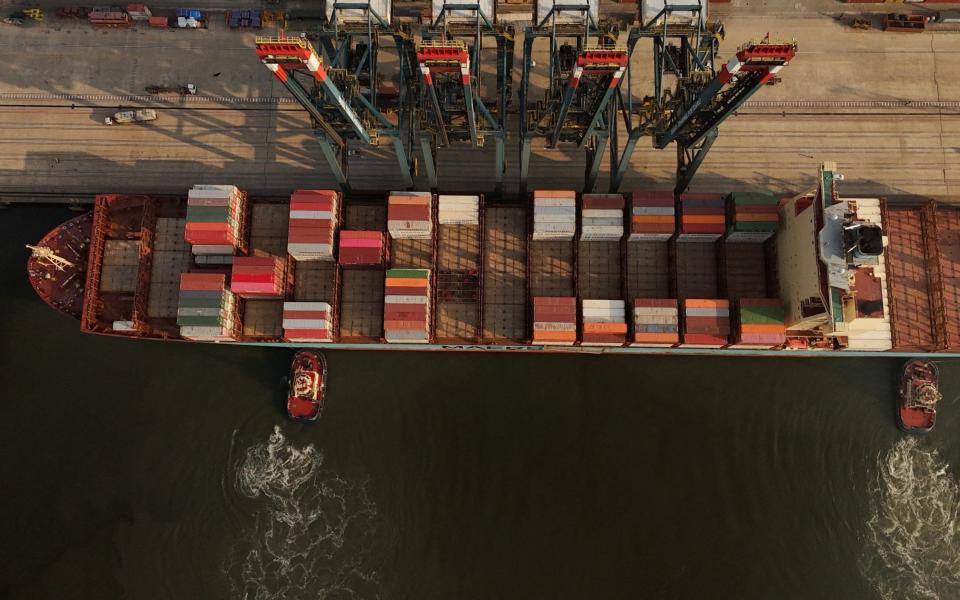

Shipping has come back into focus after Maersk upped its profit forecasts and warned it could continue diverting ships away from the Red Sea until next year.

So as a reminder of the colossal nature of this industry, here are some striking images of container ships docked in the Port of Santos in Brazil:

03:12 PM BST

Gazprom swings to £5bn loss in blow to Putin

Russian natural gas giant Gazprom plunged to a loss of 629 billion roubles (£5.5bn) last year as its sales to Europe more than halved following Vladimir Putin’s decision to invade Ukraine.

The energy giant’s shares in Moscow were down around 3.3pc after revealing the downturn, which was far steeper than the 447 billion rouble (£3.9bn) losses predicted by analysts, according to Interfax news agency.

It had made a profit of 1.2 trillion roubles (£10.4bn) in 2022.

Largely owned by the Kremlin, Moscow-based Gazprom is Russia’s largest oil and gas company.

Russia’s gas exports to Europe, once its primary export market, have fallen sharply as Gazprom became the tangible victim of Western sanctions.

It said it sustained a net loss of 364bn roubles from sales in 2023, in contrast to a profit of 1.9 trillion roubles in 2022.

Its total revenue fell to 8.5 trillion roubles last year from 11.7 trillion in 2022.

Gazprom has not published its own export statistics since the start of 2023.

02:53 PM BST

Guardian to cut journalists’ jobs as it slides back into heavy losses

The Guardian has launched a redundancy programme as the newspaper grapples with a sharp slowdown in advertising.

Our reporters James Warrington and Matthew Field have the details:

Katharine Viner, the left-leaning newspaper’s editor-in-chief, sent an email to staff on Thursday outlining plans for a “small number of voluntary redundancies” as it seeks to cut costs.

The note, seen by The Telegraph, said an “advertising recession and challenging market conditions are impacting negatively on all media companies, including the Guardian”.

The email added that The Guardian was now 60pc funded by its readers through sales and donations, cutting its reliance on advertising and newsstand sales.

However, it said the business still had to make “difficult decisions” over budgets after warning the ad slump would drive the business to a £39m loss in 2023.

Read how The Guardian has seen its headcount rise sharply since completing a three-year turnaround plan in 2019.

02:35 PM BST

US stocks jump after interest rate reassurance

Wall Street’s main indexes opened higher after the Federal Reserve left interest rates unchanged and allayed worries around potential rate rises.

The Dow Jones Industrial Average rose 172.4 points, or 0.5pc, at the open to 38,075.65.

The S&P 500 rose 30.9 points, or 0.6pc, at the open to 5,049.32​, while the Nasdaq Composite rose 152.6 points, or 1pc, to 15.758.113 at the opening bell.

02:25 PM BST

Peloton to cut 400 jobs as boss steps down

Peloton is cutting about 400 jobs worldwide and its boss is stepping down after two years as the company seeks a turnaround after its post-lockdown slump in fortunes.

Shares jumped more than 11pc in premarket trading as it announced the job reductions, which amount to about 15pc of its global headcount.

The job cuts are just the latest round for the company, which announced in October 2022 that it was cutting about 500 jobs on top of the nearly 800 layoffs it made in August of that year.

The New York company experienced incredible sales growth at the height of the pandemic as consumers were locked down, with its share price multiplying five times in 2020.

However, sales began to slow in 2021 and it lost $1.3bn (£1bn) in the fiscal year ended in June and an additional $350m (£280m) in the six months ended in December.

Chief executive Barry McCarthy, who is also stepping down from his president and board member posts, will remain with Peloton as a strategic adviser until the end of the year.

Mr McCarthy, who had taken over as boss from founder John Foley, said: “Hard as the decision has been to make additional headcount cuts, Peloton simply had no other way to bring its spending in line with its revenue.”

02:00 PM BST

Rail companies seek informal talks with union bosses

Rail companies have suggested informal talks with the train drivers’ union in a bid to resolve the long-running pay dispute, it has been revealed.

The move by the Rail Delivery Group (RDG), which represents train operators, will not affect a series of fresh strikes and an overtime ban by members of Aslef next week which will again cripple services.

No meetings have been held between the two sides for a year, while government ministers have not met Aslef since the start of 2023.

The RDG has written to Aslef suggesting informal talks which would allow more formal negotiations.

An RDG spokesperson said: “We want to see an end to this dispute and in that spirit, we have written to the Aslef leadership to try and find areas of common ground that will allow us to move to formal negotiations.”

The dispute started in the summer of 2022, since when train drivers have taken a number of strikes, causing travel chaos for passengers and huge financial hits on sectors such as hospitality.

Aslef general secretary Mick Whelan described it as a “soft touch approach” from the RDG.

01:43 PM BST

US jobless benefit claims flat

The number of new claimants of jobless benefits in the US remained flat at 208,000 last week, official figures show.

Initial claims - considered a proxy for layoffs in the economy - was slightly below analyst estimates of 211,000 for the week to April 27.

The four-week moving average of claims fell by 3,750 to 1,788,750, while the previous week’s average was revised down by 1,500 from 1,794,000 to 1,792,500.

United States Initial Jobless Claimshttps://t.co/7p2FYAmZ3d pic.twitter.com/5YgPe6isw3

— TRADING ECONOMICS (@tEconomics) May 2, 2024

01:23 PM BST

Virgin Media O2 loses 75,000 mobile customers as handset sales slow

Virgin Media O2 has reported lower customer activity over the first three months of 2024 before an increase in prices.

The UK telecoms giant said overall revenues dropped as it also witnessed lower demand for mobile handsets.

Its contract mobile base of customers dipped by 74,500 to 16m at the end of the quarter.

The group, which was formed in a £31bn deal in 2021, reported that total revenues were down 0.5pc for the quarter to £2.6bn compared with the previous year.

It added that revenues were 4.3pc lower year-on-year excluding its next-generation high-speed fibre operation Nexfibre.

The decrease was primarily driven by low-margin handset revenues, which dropped by 24.6pc.

It meant that total mobile revenues were down 4.7pc to £1.4bn despite an increase in mobile service revenues.

Virgin Media O2 said it saw “low customer activity” over the quarter with its fixed-line customer base - which covers broadband and landline - reducing by 2,000 to 5.8m at the end of the quarter.

01:04 PM BST

First insurer pays out for Baltimore bridge disaster

Chubb is understood to be preparing to make a $350m payout to the state of Maryland as the insurance industry faces up to the consequences of the collapse of Baltimore’s Francis Scott Key Bridge.

The payment is expected to be authorised within weeks, the Wall Street Journal reported.

The $350m (£279m) payout could be the first of many related to the disaster that analysts have said might cost insurers up to $4bn (£3.2bn), making it a record shipping insurance loss.

The tragedy that killed six people occurred after a Singapore-flagged container ship collided with the landmark bridge.

Chubb, along with Maryland and the families of the victims of the crash, will likely sue the ship owner and others to recoup losses from the crash, according to the Wall Street Journal.

12:53 PM BST

Santander systems ‘now working as usual’

Santander has said it has now fixed the issue with its online banking services.

A spokesman said:

We’re sorry to customers for any inconvenience caused by a temporary inability to access our banking services from 11:22am this morning.

We can confirm that we began recovering systems within 15 minutes of the issue occurring, and all systems are now working as usual.

12:24 PM BST

Santander still ‘working hard to resolve’ online issues

Santander is still tweeting customers saying it is battling to restore its online services.

It is advising customers to “try again later”.

Hi Charlie, we are aware some customers are experiencing issues accessing online services, We're working hard to resolve this as soon as possible. Please try again later. ^JM

— Santander UK Help (@santanderukhelp) May 2, 2024

12:06 PM BST

Santander UK customers report outages

Thousands of Santander UK customers have reported outages with their service, which the bank has said it is trying to fix.

Santander said it is aware some customers are experiencing issues accessing online services.

More than 2,000 reports have been made that services are offline using the reporting service Downdetector.

Santander wrote on X, formerly Twitter: “We are aware some customers are experiencing issues accessing online services, we apologise for any inconvenience this has caused.

“We’re working hard to resolve this as soon as possible.”

Hi, we are aware some customers are experiencing issues accessing online services, We're working hard to resolve this as soon as possible. Please try again later. ^JM

— Santander UK Help (@santanderukhelp) May 2, 2024

Hey Elle. We are aware some customers are experiencing issues accessing online services, we apologise for any inconvenience this has caused. We're working hard to resolve this as soon as possible. please try later. ^HS

— Santander UK Help (@santanderukhelp) May 2, 2024

Hey Billy, We are aware some customers are experiencing issues accessing online services, we apologise for any inconvenience this has caused. We're working hard to resolve this as soon as possible. please try later. ^HS

— Santander UK Help (@santanderukhelp) May 2, 2024

12:04 PM BST

Royal Mail’s six-day delivery service must continue, says minister

Royal Mail’s six-day delivery service must continue, a business minister has said, as its parent company proposes cuts.

The postal service put forward proposals in April that would see a dramatic reduction in second-class letter deliveries.

Regulator Ofcom is currently consulting on the group’s reforms which are not expected to impact first-class mail.

In the Commons today, Kevin Hollinrake urged Royal Mail to abandon its plans to reduce the service.

Conservative former minister David Mundell argued that a reduction in services would negatively affect elderly residents in rural areas.

The Dumfriesshire, Clydesdale and Tweeddale MP said: “Are ministers as concerned as I am about continued reports that Royal Mail are determined to move away from a six-day service?”

During business and trade questions, Mr Hollinrake replied:

We absolutely agree with his point. We have been very clear with Royal Mail, and indeed with Ofcom, the regulator, that we want to see a continued six-day service.

And the Royal Mail, and hopefully Ofcom, will have heard what he’s said today and what we have said today - the six-day service must continue.

11:52 AM BST

Wall Street poised to bounce as Powell reassures markets

US stock markets are on track to open higher after the Federal Reserve left interest rates unchanged and allayed fears around potential rate hikes.

While Fed chairman Jerome Powell indicated that stubbornly high inflation would push back a long-expected US rate cut, he refused to entertain talk that rates might actually need to go up again.

Money markets indicate there is a 58pc chance of the first rate cut of at least a quarter of a percentage point being delivered in September, but have priced in a greater 69pc chance of a cut in November, according to CME FedWatch tool.

Preston Caldwell, chief US economist at Morningstar, said:

The Fed’s official statement did acknowledge a ‘lack of further progress’ in inflation reduction in recent months.

But Powell expressed the strong belief that current monetary policy is sufficiently restrictive to return inflation to the Fed’s 2pc target eventually ... therefore it’s unlikely the next policy move will be a hike.

US stocks initially rose, but ended mixed on Wednesday after the Fed decision.

In premarket trading, the Dow Jones Industrial Average was up 0.4pc, while the S&P 500 has risen by 0.6pc. The Nasdaq 100 was higher by 0.9pc.

11:39 AM BST

Nightcap considering Revolution Bars takeover

Late-night bar group Nightcap has said it is “assessing a number of possible options” following talks with troubled Revolution Bars, including taking over its rival.

It said it has not yet made a formal offer but said its options include buying some Revolution sites or operating subsidiaries, or some of its brands or assets.

It said its evaluation of its options is “at a relatively early stage”.

11:25 AM BST

Pound falls as US holds interest rates steady

The pound has dropped slightly after the US Federal Reserve opted to hold interest rates steady for a sixth consecutive meeting.

Sterling was down 0.1pc against the dollar at $1.25 as the Fed kept its benchmark rate at 5.25pc to 5.5pc - its highest level since 2001.

The pound was flat versus the euro, which is worth 85p.

11:00 AM BST

Mirror publisher suffers hit as Facebook downgrades news articles

The publisher of the Mirror and Express newspapers has posted a drop in revenues for the first quarter as changes to Facebook’s algorithm hit its page views.

Our reporter James Warrington has the details:

Reach reported an 8.5pc fall in digital revenues in the first three months of the year, which it blamed on the “well publicised” deprioritisation of news across social media platforms.

Unlike publications with a subscription-based business model such as The Telegraph, Reach relies on advertising income, meaning changes in traffic from social media can greatly affect its revenues.

Facebook, which is owned by Meta, has begun downgrading news articles on its platform, while it is winding down deals to pay publishers and has shut down its news tab entirely.

Twitter has also taken steps to deprioritise news, including by removing headlines from articles, as boss Elon Musk tries to keep users on the website.

Read how the changes have hit Reach.

10:40 AM BST

German births fall to lowest level in a decade

German births have fallen to their lowest level in a decade in a sign of the demographic challenges facing Europe’s largest economy.

The number of babies born last year dropped by 6.2pc compared to 2022 to the lowest level since 2013, according to the federal statistics office Destatis.

Germany’s economy is contending with an ageing population, which is also facing a declining number of marriages.

The 7.6pc decline in nuptials took the number of marriages to their lowest level since records began in 1950, excluding the pandemic year of 2021.

This chart illustrates the declining number of births:

2023 wurden in Deutschland rund 693 000 Kinder geboren, ein Rückgang gegenüber dem Vorjahr von 6,2 %. Die Zahl der #Geburten sank auf den niedrigsten Stand seit 2013. Die Zahl der #Eheschließungen sank um 7,6 % auf den zweitniedrigsten Wert seit 1950: https://t.co/28rlyUAkQE pic.twitter.com/haqmhOZZoN

— Statistisches Bundesamt (@destatis) May 2, 2024

10:19 AM BST

Shipping giant warns Red Sea trade disruption could last until next year

Shipping group Maersk said it could continue to avoid the Red Sea shipping route until next year, potentially raising the cost of goods as a result of longer transport times.

The Danish company raised its profit guidance as it continued to divert ships around the southern tip of Africa to avoid attacks by Houthi militants on vessels in the Red Sea.

The diversion around the Cape of Good Hope has been in place since December and has sent freight rates higher because of the longer sailing times.

Maersk said underlying first-quarter profits fell to $1.6bn (£1.3bn) from nearly $4bn (£3.2bn) a year earlier, but this was better than expectations of $1.5bn (£1.2bn).

Maersk said it now expects full-year underlying profits between $4bn and $6bn, compared with previous guidance between $1bn and $6bn.

Chief executive Vincent Clerc said:

This not only supported a recovery in the first quarter compared with the previous quarter, but it also provided an improved outlook for the coming quarters.

We now expect these conditions to stay with us for most of the year.

10:01 AM BST

Gas prices rise amid demand from Asia

Wholesale gas prices have ticked up as demand from Asia is expected to pick up during the summer months.

Europe’s benchmark contract rose as much as 5.1pc after falling on Wednesday as sweltering heat in the Philippines drives up the use of air conditioning.

Meanwhile, tensions in the Middle East continue to raise concerns about supplies.

The equivalent UK gas contract rose as much as 5.7pc.

09:47 AM BST

Revolution Bars confirms takeover talks

Troubled bar chain Revolution has confirmed it held talks with rival operator Nightcap over a potential takeover deal.

Revolution Bars Group said it held “an exploratory meeting” with Nightcap, which runs 46 bars including the Cocktail Club and Dirty Martini chains.

The firms held discussions around “a range of possible transactions”, including a possible offer for the entirety of Revolution, which also owns Peach Pubs and Revolucion de Cuba venues.

It comes weeks after Revolution announced a major restructuring plan which could see 18 of its bars shut down.

The company said it had been hammered by cost-of-living pressures and regular train strikes affecting its younger customer base.

Revolution also raised £12.5m through a fundraise to help support the plan, with backing from investors such as former Pizza Express chairman Luke Johnson.

09:29 AM BST

Europe’s most-valuable company battles to keep up with demand for weight-loss drug

Europe’s most-valuable company revealed better-than-expected profits for the first three months of the year as it races to boost output of its miracle Wegovy weight-loss drug.

Novo Nordisk raised its profit outlook for this year as it plans to double its investment in manufacturing capacity this year to about $6.4bn (£5.1bn) to meet runaway demand for the weekly injection.

Shares slipped 2.2pc in early trading despite saying it now expects sales growth this year of between 19pc and 27pc in local currencies, compared to the previously guided range for 18pc to 26pc growth.

Operating profit growth this year is now seen at between 22pc and 30pc in local currencies, slightly up from its previous forecast of 21pc to 29pc.

Shares in Novo have risen around 260pc since it launched Wegovy in the United States in June 2021.

However, the company is facing fierce competition from US rival Eli Lilly as it rolls out its Zepbound therapy in new markets. It launched in the United States in December and in Britain, Germany and Poland.

09:16 AM BST

German downturn leaves European manufacturers in recession

European manufacturers remained in recession as output was dragged down by poor performance in Germany, closely watched data showed.

The HCOB Eurozone Manufacturing PMI - considered a key measure of economic health - slumped to a four-month low of 45.7.

A reading below 50 indicates a contraction - and the eurozone has been in this negative territory for 22 consecutive months.

Germany and Austria were the worst performers, although the figures showed that factory production shrank at the softest rate in a year.

Germany’s manufacturers delivered a reading of 42.5, which was well below the average recorded (44.0) since the current downturn in business conditions began in mid-2022.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said:

What is going to rescue the eurozone economy? While this is a difficult question, one thing is clear: It’s not the manufacturing sector.

Instead, this sector is prolonging its drawn out recession into April. Output shrank at a similar pace as in the months before and companies have reduced their purchases at an accelerated rate.

Of particular concern is Germany, the industrial powerhouse, grappling with a pervasive downturn spanning key sectors including capital goods, intermediate goods, and consumer goods.

09:01 AM BST

Oil rises after hitting seven-week low

The price of oil is bouncing back after dropping to a seven-week low.

Brent crude, the international benchmark, has gained 0.9pc to more than $84 a barrel after slumping to the lowest since mid-March on Wednesday.

The drop came as US crude stockpiles jumped by 7.3m barrels last week, the most since early February, according to data released by the Energy Information Administration.

Oil has lost more than 5pc this week amid hopes of a ceasefire in Gaza. Last month it soared to the highest since October following Iran’s unprecedented attack on Israel.

08:37 AM BST

Shell and Standard Chartered boost FTSE 100

The FTSE 100 rose as shares of Shell and Standard Chartered jumped after strong results.

The blue-chip index was last up 0.3pc, hovering just below its record high of 8,199.95 points hit on Tuesday.

Shell climbed as much as 1.7pc after the energy giant reported a much better-than-expected first-quarter profit of $7.7bn (£6.1bn) on the back of strong oil trading and higher refining margins.

Standard Chartered jumped as much as 7.2pc to lead gains on the FTSE 100 after the emerging markets-focused lender posted a 5.5pc rise in first-quarter pre-tax profit.

Asian markets rose too, while other European markets were subdued after the US Federal Reserve kept interest rates steady as expected on Wednesday.

Chairman Jerome Powell suggested future policy moves could be to keep holding or cutting rates rather than a hike.

Meanwhile, traders are now only fully pricing in a first rate cut by the Bank of England in September.

The mid-cap FTSE 250 was flat after two sessions of losses.

08:30 AM BST

Pandora boosts market share despite shrinking jewellery demand

Pandora, the world’s largest jewellery maker, raised its full-year revenue guidance after beating first quarter sales and profit forecasts as it won market share in the United States.

The Danish company’s shares jumped 5pc in early trading.

Pandora has invested heavily in marketing, store openings, and broadening its range of rings, necklaces, and lab-grown diamonds, though its charm bracelets ranging from $60 to more than $2,000 still make up around 60-70pc of sales.

Sales jumped 11pc in the first quarter to 6.8 billion Danish krone (£799.9m), including a 9pc increase in the United States, where the brand is gaining market share even as overall demand for jewellery has weakened.

Chief executive Alexander Lacik told Reuters: “The reason we are gaining share fundamentally is because we keep investing in this brand. Even when there is a shrinking pie, you will find winners and losers.”

08:19 AM BST

Universal reaches new licensing agreement with TikTok

Universal Music Group and TikTok said that they had reached a new licensing agreement that will restore the label’s songs and artists to the social media platform.

TikTok began removing Universal’s content from its app after their licensing deal expired in January and the two sides failed to reach agreement on royalty payments to artists and songwriters, protections from artificial intelligence (AI), and online safety for TikTok’s users.

The short video app is a valuable marketing and promotional tool for the music industry. TikTok is where 16- to 19-year-olds in the US most commonly discover music, ahead of YouTube and music streaming services such as Spotify , according to Midia Research.

“Roughly a quarter of US consumers say they listen to songs they have heard on TikTok,” said Tatiana Cirisano, Midia’s senior music industry analyst.

08:08 AM BST

Shell shares jump as profits top £6.1bn

Shell shares have risen 1.4pc in early trading on the FTSE 100 after it revealed better-than-expected profits in the first three months of the year.

Stuart Lamont, investment manager at RBC Brewin Dolphin, said:

Shell has beaten expectations by a reasonable margin, despite the impact of lower gas prices during the first quarter.

Earnings are up, costs have fallen, and the oil and gas major has brought debt down too – all in all, it’s a solid set of numbers and underlines why the market, generally, remains bullish on Shell.

Investors were looking for reassurance on volumes and capital discipline, as these ultimately feed through to cash returns.

Today’s update has delivered on both fronts, with the addition of an extension to the share buyback programme.

08:06 AM BST

UK markets rise as fears of US rate rise ease

The FTSE 100 began the day higher after US Federal Reserve chairman Jerome Powell appeared to quash any concerns that there could be any interest rate rises in America this year.

The UK’s blue chip stock index rose 0.3pc to 8,145.80 while the midcap FTSE 250 gained 0.1pc to 19,989.31.

08:03 AM BST

Britain on course to be slowest-growing country in G7, warns OECD

High taxes and interest rates will make Britain the slowest-growing economy in the G7 next year, the Organisation for Economic Co-Operation and Development (OECD) has predicted.

Our deputy economic editor Tim Wallace has the details:

Economists at the Paris-based group on Thursday downgraded the outlook for Britain, predicting GDP will rise by just 0.4pc this year and 1pc in 2025 as high borrowing costs and taxes weigh on the economy.

The outlook for next year is the worst of any other major developed economy in the OECD and almost half the 1.8pc growth expected in the US.

Forecasters blamed high taxes and interest rates, as well as rapidly rising public spending, for holding back Britain.

Read what Chancellor Jeremy Hunt said about the forecasts.

07:54 AM BST

Standard Chartered profits jump in boost to ‘crap’ share price

Standard Chartered profits surpassed expectations in the first three months of the year, delivering a boost three months after its boss admitted the bank’s share price is “crap”.

The Asia-focused bank revealed underlying pre-tax profits increased by 27pc to $2.1bn (£1.7bn), which was ahead of analyst estimates of $1.6bn (£1.2bn).

Operating income was up 17pc to $5.2bn (£4.2bn), while its net interest income was up 5pc on a constant currency basis to $2.4bn.

Shares in the UK-headquartered-bank jumped 5pc in Asian trading, with its London listed shares poised to rise shortly.

Despite a 19pc rally in the share price since February when Mr Winters made his “crap” comment. Standard Chartered’s stock has declined more than 30pc since he took the helm at the British lender in June 2015.

Mr Winters said:

We delivered a strong set of results in the first quarter of 2024, with double-digit growth in income and positive operational leverage.

Business performance was strong and broad-based across our segments, products and markets in what continues to be an uncertain environment.

We have taken action to create a simpler and more efficient organisation with changes to our group management structure and we are advancing our Fit for Growth programme.

07:42 AM BST

Shell profits ‘an affront to the world’, say campaigners

After Shell’s latest results, Izzie McIntosh, climate campaign manager at Global Justice Now, said:

As extreme weather accelerates and the cost-of-living crisis rumbles on, Shell’s latest billion-pound profits are an affront to the world.

The grotesque wealth that this earth-wrecking company continues to accumulate is something we cannot allow ourselves to accept as normal.

We urgently need to bring a fair and organised end to the fossil fuel era, and that means companies like Shell must stop trying to extract new oil and gas, and start paying what they owe for the loss and damage they’ve caused.

Profit announcements like this for a corporate dinosaur like Shell need to become a thing of the past.

07:40 AM BST

Co-operative Bank turnaround ‘materially complete,’ says boss

The Co-operative Bank said its transformation plan is “materially complete” ahead of its agreed merger with Coventry Building Society.

Nick Slape, the boss of the high street bank, said he was “very pleased” with its performance over the first quarter of 2024.

Co-op Bank said its financial performance is in line with expectations and held firm its guidance for the year.

The company told shareholders its “multi-year transformation programme (is) materially complete”, after significant cost-cutting which included proposals to cut around 400 jobs earlier this year.

Mr Slape, chief executive officer, said:

Our low-risk balance sheet remains resilient, with all key financial metrics and credit quality in line with expectations.

We are focused on delivering value to our shareholders through the strength of our business model and the hard work of our colleagues.

07:28 AM BST

Shell smashes estimates with £6.1bn profit

Shell surpassed market expectations with a $7.7bn (£6.1bn) profit in the first three months of the year and announced fresh returns to shareholders.

The oil giant had been expected to record first quarter profits of about $6.3bn (£5bn) but surprised markets with a result that was more than £1bn better than expected.

However, its adjusted net income - its preferred measure of earnings - was still down from $9.7bn (£7.7bn) the previous year, when it was still reaping the benefits of the energy price shock caused by Vladimir Putin’s decision to invade Ukraine.

The FTSE 100 oil giant announced it would repurchase another $3.5bn of shares in the second quarter after the strong performance, matching the buybacks of the previous two quarters.

Last year, it returned a total of $23bn to shareholders.

Chief executive Wael Sawan said: “Shell delivered another quarter of strong operational and financial performance, demonstrating our continued focus on delivering more value with less emissions.”

07:22 AM BST

Good morning

Oil giant Shell surprised markets with profits that came in more than £1bn higher than analyst estimates.

Adjusted net income, its preferred measure of profits, hit $7.7bn (£6.1bn) in the first quarter, which was down from $9.7bn (£7.7bn) in the same period last year but well ahead of expectations of $6.3bn (£5bn).

5 things to start your day

1) Shell to close Chinese green power generation business | Decision comes amid wider Western exodus from communist country

2) PwC partners in the Middle East accused of blocking first woman boss | Firm faces backlash from own staff over result of vote for senior partner

3) HSBC investors demand greater focus on Asia under new boss | Bank should consider candidates with more experience in the region, say shareholders

4) Labour waters down late-night work email ban championed by Angela Rayner | Party no longer plans to incorporate ‘right to switch off’ into law

5) Black cab drivers sue Uber for £250m over illegal London licence claims | More than half the capital’s cabbies seeking £25,000 in compensation

What happened overnight

Asian markets wobbled after a mixed finish on Wall Street with the Federal Reserve delaying cuts to interest rates.

Tokyo’s Nikkei 225 index opened with a decline, then climbed 0.1pc to 38,299.71.

The Japanese yen surged as much as 2pc in early Asia hours, driven by speculations of another round of yen-buying intervention by Japanese authorities.

Later, the yen reversed its course and erased the previous gains. By midday, the dollar was trading at 156.04 yen, up from 154.91 yen.

In South Korea, the Kospi edged 0.1pc lower to 2,688.80, after official data showed the country’s consumer prices in April reached 2.9pc year on year, a slower pace compared to the data in March.

Hong Kong’s Hang Seng index added 2.3pc to 18,178.43. Other markets in China remained closed for the Labor Day holiday.

Elsewhere, Australia’s S&P/ASX 200 advanced 0.5pc to 7,603.80.

In America, the S&P 500 fell 0.3pc, to 5,018.39, after the Fed held its main interest rate at its highest level since 2001, just as markets expected. The index had rallied as much as 1.2pc in the afternoon before giving up all the gains at the end of trading.

The Dow Jones Industrial Average rose 0.2pc, to 37,903.29, and the Nasdaq Composite index lost 0.3pc, to 15,605.48.

Yahoo Finance

Yahoo Finance